She made sure to provide her three children with every opportunity she could, taking them to ballet lessons, after-school academic programs, plays and activities around the city, encouraging them to work hard at school and stay away from drugs. But the specter of violence and poverty was hard to escape.

Hard to escape, that is, until Harris got an opportunity to move out of the projects to a small village called Alsip, 40 minutes outside of Chicago's city center and 80% white. Harris moved to Alsip 14 years ago and since then has led a quiet, suburban life alongside neighbors who go to work each day and raise their children to go to college.

Harris and her children thrived in Alsip. One of her daughters just graduated from college with a double bachelor's degree in business administration and early childhood education, another is in a bachelor's program for nursing and is a manager at a McDonald's while she attends school. As for her friends who stayed in Altgeld Gardens, Harris told me, "their children have children. My children don't."

Related: The most innovative cities in America

There are hundreds of programs that seek to improve the outcomes of people who live in concentrated poverty. But as Harris and thousands of other mothers like her have demonstrated over the past half century, one of the most effective strategies for lifting families out of poverty is to plunk them down in a completely new neighborhood far away from their past lives.

The program that helped Harris move to Alsip was the result of a lawsuit originally filed in 1966, still being litigated today, referred to as Gautreaux for the original plaintiff, who died in 1968. Among other things, a consent decree related to Gautreaux required the Chicago Housing Authority to provide vouchers for black residents to move to white suburbs beginning in the 1970s. Many of the families who moved to the suburbs stayed there, and their children were more likely to stay out of trouble and go to college than families who stayed within the city.

Despite the strategy's success in Chicago, nationally there are few programs today that focus on helping African American families move from racially segregated, high-poverty neighborhoods to areas where their children will have access to good schools and less exposure to crime. Those that do exist are all results of lawsuits.

One in Baltimore seeks to move 4,400 families to better areas by 2018. Another, in Dallas, exists as a result of a lawsuit filed in 1985. And on Thursday, a Chicago judge approved a Gautreaux-related settlement that -- among other things -- will allow a new host of families to be relocated, with the help of a counselor, to low-poverty, higher-opportunity neighborhoods.

Related: Cleveland's plan to destroy 6,000 homes

Programs like these are small compared with the scale of the problem: Cities are still extremely segregated.

In Chicago, African Americans tend to live in areas where the riots of the 1960s took place, areas that are almost entirely African American today. There are still municipalities in the greater Chicago area with less than 1% African American population, according to a Fair Housing and Equity Assessment from 2013. There are no municipalities where Hispanics make up more than 90% of the population, something that's not true for African Americans, the report says.

The continued segregation, despite decades of anti-poverty programs, raises a question: Should housing authorities be making a more conscious effort to help people who live in segregated, low-income neighborhoods move to wealthier, more diverse areas?

Alex Polikoff, one of the attorneys who filed the Gautreaux case in 1966, says it's a no-brainer. He continues to work on legislation related to Gautreaux and is behind Thursday's agreement, which will require Chicago to move about 200 families in a Gautreaux-type program.

"We know so much about the harm of young kids growing up in severely-distressed neighborhoods. If we have a way to enable kids to escape to better life opportunities, it's immoral not to do that," he said.

* * *

It was while downing pizza on his birthday in January of 1966 that Polikoff was first presented with the idea that the way the Chicago Housing Authority was building new public housing violated the Constitution.

He was a volunteer attorney for the ACLU at the time, and over lunch a friend from the Urban League told him about complaints from a coalition of black organizations that the housing authority was only building new housing projects in black neighborhoods, he recounts in his book, Waiting for Gautreaux. The selection of public-housing sites was politically motivated: The housing authority couldn't buy land in white neighborhoods without the city council's approval. But keeping black people in black neighborhoods violated the equal-protection clause of the Constitution, Polikoff argued, and that argument formed the basis for the lawsuit he filed in August of 1966.

In 1969, a federal judge in Chicago issued an order preventing the housing authority from constructing new public housing in predominantly African American neighborhoods unless it also built public housing elsewhere. It also prohibited the city from constructing dense concentrations of public housing.

Not satisfied with this settlement, Polikoff argued that the U.S. Department of Housing and Urban Development (HUD) should be required to remedy its past errors, and in 1976, the Supreme Court agreed, ruling that the government could be required to use the entire region to do so. A consent decree led to HUD agreeing to fund a voucher program to move black families to the suburbs.

"We thought we were not going to prevail," he told me. "But I think when we amassed the evidence through discovery, the evidence was compelling—they were doing this because they felt they had to keep black people out of white neighborhoods."

Related: America's 10 most unequal cities

Between 1976 and 1998, more than 7,000 families received vouchers through Gautreaux, about half of whom moved to 115 suburbs around Chicago, with the assistance of placement counselors. Suburbs that were more than 30% black were excluded from the program. Families that had more than four children or bad credit did not qualify, nor did those who had been found to have damaged their rental housing.

The move was difficult at first for the families, as James Rosenbaum and Leonard S. Rubinowitz documented in their book about Gautreaux, Crossing the Class and Color Lines: From Public Housing to White Suburbia. In the racially-charged times of the 1970s, black families were sometimes harassed on the streets by whites, followed by teenagers in cars, or called racial slurs. One girl who entered a white school was so unaccustomed to seeing so many white faces that she turned around and ran home.

But many of the families said these threats were nothing compared to the violence they'd been subjected to in the inner cities.

"Here in the suburbs, I don't have to worry about people shooting at people, seeing people chase people, fighting," one woman told the researchers.

Such anecdotal accounts line up with the data: Scholars who have studied the program have found that families who moved to the suburbs were able to achieve more in school and work, not having to worry about violence.

Related: Part-time jobs put millions in poverty

"What I saw over and over again was that low-income kids had unseen potential that they could not see in the housing projects and that emerged when they moved," said James Rosenbaum, a professor of sociology at Northwestern who extensively studied the Gautreaux families.

A study of suburban Gautreaux mothers in the 1990s found that they were more likely to be employed than mothers who had received vouchers to move within the city. Gautreaux children in the suburbs were more likely to graduate from high school, attend four-year colleges, and to have jobs than their peers who had moved to other city neighborhoods. They also had higher pay and benefits than the other children. Even mothers who had not had jobs before were more likely to get jobs if they moved to the suburbs, Rosenbaum told me in an interview.

Later research showed that two-thirds of the families remained in the suburbs 15 years after their move. Long after the program ended, mothers who moved through Gautreaux continued to live in low-poverty areas and have higher household incomes.

Gautreaux isn't easy to empirically evaluate -- it didn't have a control group, and some scholars have questioned whether its effects are really significant, since the participants were screened. But Rosenbaum said some of the families who moved were just following someone else, and were sometimes not good parents at the outset.

"I don't think the 'self-starter' model really describes a large number of them," he said. "You had a thorough change in environment, and there were some high achievers, but even the average and below-average kids in the suburbs can expect good outcomes. That kind of kid in the city cannot."

* * *

Partially because of the success of the Gautreaux program, HUD decided to sponsor a randomized experiment to see whether such an approach could be scaled. Called Moving to Opportunity, the program, which began in 1994, selected families from some of the most distressed housing projects in Chicago, Baltimore, Boston, Los Angeles, and New York. Between 1994 and 1998, the program enrolled 4,604 families. Three-quarters were on welfare and fewer than half of the household heads had a high-school diploma.

Moving to Opportunity was a randomized experiment, and had a control group that did not receive access to any new services through the housing authorities. One group of families got a voucher to move to private-market housing in low-poverty areas and another group got a traditional Section 8 voucher, which they could use to move anywhere.

Related: 5 biggest threats to the housing market

Disappointingly, the results from this program were not as positive from those in Gautreaux, though some recent students show positive long-term health effects on families who received vouchers to move to better neighborhoods. Adults were generally not more self-sufficient after moving, and children did not achieve more in school than the non-movers. Girls who moved participated in fewer risky behaviors, but boys who moved actually participated in more.

That's because Moving to Opportunity differed from Gautreaux in a few key ways, Rosenbaum says. Families who moved were given the chance to move to a neighborhood with lower poverty, but unlike Gautreaux, families weren't encouraged to move to areas that were majority white. That meant many of the families ended up close by their old neighborhoods -- in some cases, kids attended the same schools they had before. Families often ended up in slightly better neighborhoods that were still segregated from the rest of the city's population.

With Gautreaux, about 90% of the families who went to the suburbs moved more than 10 miles away, Rosenbaum said; with MTO, 84% moved less than 10 miles away.

Moving to Opportunity also targeted families who lived in extremely high-poverty public housing, where mothers were often struggling with mental-health issues and might have had more difficulty with unfamiliar settings.

The results of Moving to Opportunity showed that race is still a factor in providing access to opportunity, said Ruby Mendenhall, a sociology and African American studies professor at the University of Illinois at Urbana-Champaign who wrote her dissertation on Gautreaux. After all, she said, many of the African American mothers who moved to the suburbs were able to benefit from nearby educational institutions to get ahead. They often found better-paying jobs and got off government assistance in part because of the relationships they made with their predominantly white neighborhoods.

"Unfortunately in our country, more white or integrated areas tend to have more resources, so when race isn't a factor, I think that some relationships aren't on the table," she said.

These results have led federal and state policymakers to largely abandon mobility programs, scholars say. But others argue that the results of MTO shouldn't undermine the success seen in Gautreaux -- Moving to Opportunity was a much weaker program than Gautreaux, even if it was a more scientifically accepted study.

"People have misread MTO, and said, 'Here, we did residential mobility, and it didn't work,'" Rosenbaum said. "That is the wrong message."

* * *

It's hard to imagine that housing-mobility programs wouldn't help residents of Chicago today, which is still one of the most segregated cities in America.

As my colleague Ta-Nehisi Coates outlined in his piece in June's magazine, "The Case for Reparations," discriminatory housing policies in Chicago, and much of the country, have systematically created areas of disadvantage where black residents have less access to opportunity than whites. North Lawndale, the neighborhood he visited, is 92% black. Its homicide rate is triple the rate of the city as a whole, and 43% of residents live below the poverty line -- that's double the rate of the city as a whole.

The city of Chicago has implemented policies seeking to remedy some of that segregation: As a result of a federal program, Chicago in 2000 began its Plan for Transformation, with the goal of dismantling most high-rise public housing complexes such as the infamous Cabrini Green. About 40% of the thousands of households received vouchers which they could use in the private market anywhere they wanted, whether it be in the suburbs, or outside of the state. But only 60 residents using those vouchers now live in the suburbs, and only 11 live out of state, according to a report from the Chicago Housing Authority.

Many of the families being located from the housing towers ended up in all-black neighborhoods where opportunities were only minimally better than they had been before.

Joel Hamernick, who runs a ministry in Woodlawn, an area on the South Side of Chicago, said that the area has seen an influx of families from Cabrini Green (his ministry, too, relocated from Cabrini Green, about a decade ago). That has caused some turf wars among gangs, and increased violence, and caused some families to leave the neighborhood.

"Towards this end, the neighborhood is getting worse," said Kelai Price, who has lived in Woodlawn her whole life, told me when I ran into her in a coffee shop in Chicago last month for a story about Woodlawn.

Many residents of Chicago's public-housing towers didn't want to move far because they had lived in the neighborhood their whole life, and didn't know anywhere else, said Susan Popkin, a scholar at the Urban Institute who has studied where the residents went. In fact, many of the residents who ended up in public housing or mixed-income housing had better experiences than those who received vouchers because they didn't have to deal with private landlords and the stresses of the rental market.

"When it came down to it, a lot of them had lived there for generations, and they wanted to go somewhere comfortable and familiar," she said. "Unless they had a connection, they weren't interested in going any further."

In fact, families who receive Section 8 vouchers rarely leave the neighborhoods that are familiar to them, said Stefanie DeLuca, a sociology professor at Johns Hopkins who studied Gautreaux and Moving to Opportunity with James Rosenbaum. Her research has found that families often get little notice that they're receiving a voucher, and then scramble to find a place before the 60-day window in which they have to use it runs out.

"Families settle for units that they know are subpar out of fear of losing the voucher," she wrote, in a study published in 2013 that looked at families in Mobile, Alabama, who received vouchers. Many also spent their whole lives in poverty and knew little about neighborhoods outside their immediate area.

With some counseling and guidance, though, families who receive vouchers can have much better outcomes, DeLuca said, especially if they're directed to homes in high-opportunity target areas.

Related: Where zombie foreclosures are making a comeback

She has now turned her attention to the ongoing Baltimore Mobility Program, which has provided vouchers for 2,600 families since 2003, and says it's an example of how a mobility program can succeed.

"This voucher gets them into the kinds of neighborhoods that have real opportunities for schools, and safety, and high-quality housing," she said. "There appears to be a durability of this program that's strikingly different from MTO, much more like Gautreaux."

The Baltimore program requires residents to live in areas that are less than 10% poor, less than 30% black, where no more than 5% of residents live in subsidized housing. Baltimore provides housing-search counseling to participants, as well as post-move counseling, and requires residents to remain in the area for at least two years. Families also get some assistance with security deposits, attend credit-repair workshops, and go on tours of outlying counties to familiarize themselves with the options.

In her field work, which examined 110 households in depth, DeLuca found that living in a different neighborhood helped the Baltimore families make better choices when it came to housing and their children's schooling. Families had higher expectations for the neighborhoods where they lived and showed "new appreciation" for racial and ethnic diversity and good schools, often becoming willing to make difficult trade-offs for the sake of their families.

Parents said it was a new world: One woman told researchers that she now goes to work, comes home, pays the bills and has fun with her children, whereas she used to go drinking with friends. Another said her kids appreciated not being woken in the middle of the night by sirens and gunshots. Another mother said her 12-year-old son now cried because he was so happy to go to school in the morning and do his homework.

Related: Buying a home is easier if you're white

For DeLuca, the successes of the Baltimore program indicates that it's not enough to just expect people with vouchers for housing or schools to pick the right places to live or to send their children. They aren't used to having good options to pick from, she said.

"Disadvantaged families have only been exposed to low-performing schools and unsafe neighborhoods, and have to come to expect the inevitability of those things," she said. "Experiences like the ones families had with Gautreaux and the Baltimore program -- it's eye-opening. It opens up a whole world of possibilities, and it's hard to understate the transformative power of that."

It's something that Seitia Harris knows all too well. When she moved to Alsip, she says, her family was at first unaccustomed to peace and quiet. There were no more people hanging out on the street corner or shots at night. Parenting plays a role in a child's development, she said, of course. But before she moved, she was a good parent in a bad environment, where there was too much exposure to drugs, negativity, and gangs.

"Seeing people getting up every day and working, wanting to get something out of life -- it taught them better values" than they were exposed to in the projects, she said.

* * *

Of course, moving some families to more affluent suburbs doesn't help the families left behind, and policymakers say there also need to be programs focusing on improving the lives of people in concentrated poverty.

"It needs to be a two-pronged approach -- you can't ignore what happens in these neighborhoods," said Mendenhall, the University of Illinois scholar.

That can be something as simple as improving the quality of the housing available to low-income families, said Popkin, the Urban Institute scholar. In her work studying the families moved out of Chicago's public-housing towers, Popkin found that even families who moved to the same neighborhood but better homes -- such as the mixed-income complexes -- said their lives had improved. Of course, those families saw no marked improvements in educational or employment outcomes, but their living situations were at least better than they had been.

"At its most basic level, for what it was supposed to accomplish, it actually came out better than I and a lot of other observers would have predicted," she said, about the relocations.

Related: What will your monthly mortgage payment be?

Families who were given intensive case management to help with the move were even more successful, she said. Their employment prospects improved, as did their mental and physical health.

That's why it could be argued that spending money on counseling and mixed-income housing for a whole host of families is more worthwhile than spending it to move just a few families to a completely new neighborhood.

"Thats why theres an ongoing debate about these mobility programs," Popkin said. "Is it worth spending that much money on a handful of families?"

After all, suburbs are no longer the bastions of privilege they once were (though majority white suburbs still, for the most part, are). Since the recession, it's the exurbs in Chicago that have had job growth, while affordable housing near those jobs is often hard to find. Poverty is growing in suburbs across the country, including in Chicago, and moving families blindly out of the city may do more harm than good.

That's why Chicago's leaders are now focusing on helping low-income people live in mixed-income neighborhoods in both the suburbs and the city that have good access to transit and jobs, high homeownership rates, low commute times, walkable areas and a low percentage of people receiving public-housing assistance, said Robin Snyderman, a non-resident senior fellow at the Brookings Institution who also works as a consultant on housing policy in Chicago.

Related: I bought a house for $1,000 in Detroit

Nine housing authorities now participate in a regional pool of resources that began more than a decade ago. They include authorities in counties such as DuPage, Lake, and McHenry, using the money to build nearly 30 mixed-income developments in "opportunity areas" that are near transit and job opportunities.

"Just getting rental housing into some of these communities was hard to do for many years," said Snyderman said.

A pilot program launched in 2011, the Chicago Region Housing Choice Initiative (CRHCI), encourages families to use vouchers to move to some of these locations, giving them counseling to help them do so.

Regional authorities and mayors have "adopted new tools for promoting inclusion and diversity, building on the lessons learned from Gautreaux," she said. "I feel more hopeful that the historic segregation in the Chicago region can be transformed -- because it's now not all on the shoulders of the public housing authority," she said.

Still, for Alex Polikoff and some other advocates, the progress that's been made in the past century is not enough. He understands why mobility programs aren't politically viable. After all, using a more expensive voucher to help one family move to the suburbs might mean that fewer families get off the very-long waiting lists for housing assistance. And wealthy neighborhoods often don't want low-income families moving in through government programs.

Related: What to do with a dying neighborhood

But Polikoff strongly believes that housing authorities should make more effort to help some families move far away from the segregated inner city to suburbs where their lives will change, much in the way the lives of the original Gautreaux families changed decades ago. After all, voucher programs that allow residents to go to the private market haven't been effective in desegregating neighborhoods.

He's still battling the Chicago Housing Authority on the issue. The Thursday ruling made official a settlement between Polikoff's firm and the Chicago Housing Authority, allowing the city to extensively rehab Altgeld Gardens, the housing complex where Harris once lived. But in addition to the rehab, Polikoff extracted a promise from the city that it would also issue 218 vouchers to families with children on the CHA waiting list, enabling them to move to designated "Opportunity Areas" and receive pre and post-move counseling.

It's not just Chicago -- Polikoff has proposed a "national" Gautreaux program, making 50,000 housing-choice vouchers available to black families who live in segregated areas, which could be used only in census tracts with less than 10% poverty and fewer minorities. The number of families would be limited, to avoid "threatening" a receiving community, he wrote in a proposal in 2004 (Polikoff told me he still supports this proposal).

I asked Polikoff if this policy could be seen as "reparations" of sort. Not reparations, he said. But an apology to the African American community for centuries of discrimination.

"In a sense it's a very small part of playing makeup here," he said. "We owe it to them to remedy the discrimination of the past, among many other things we owe them."

This article originally appeared on The Next Economy, a joint project of The Atlantic and National Journal.

CNNMoney (New York) February 13, 2015: 7:21 PM ET

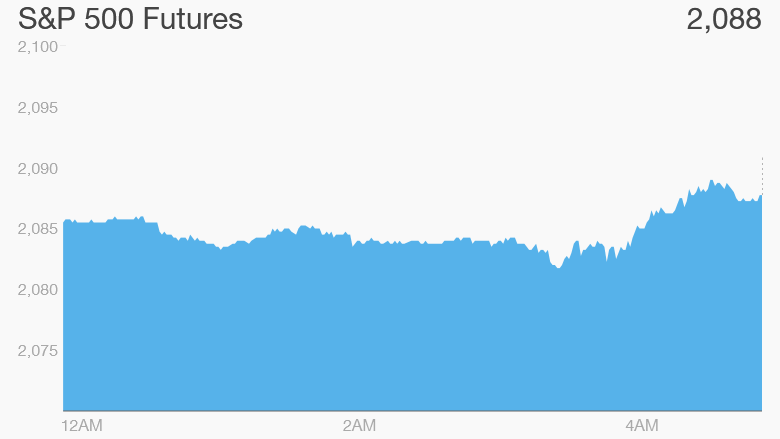

Click on the chart for in-depth premarket data.

Click on the chart for in-depth premarket data.  Twitter CEO Dick Costolo was injured while skiing.

Twitter CEO Dick Costolo was injured while skiing.

"We believe deeply that everyone has a right to privacy and security," Tim Cook asserted Friday.

"We believe deeply that everyone has a right to privacy and security," Tim Cook asserted Friday.