Black-clad lawyers gather at Hong Kong's Court of Final Appeal to protest Beijing's influence.

Black-clad lawyers gather at Hong Kong's Court of Final Appeal to protest Beijing's influence. HONG KONG (CNNMoney)

The pro-democracy protests, which recall the Occupy Wall Street movement in New York, have divided the powerful business community. Some worry that they could deter investors.

Tuesday's march to the city's business district takes place on the 17th anniversary of Hong Kong's handover from British to Chinese rule, and could attract hundreds of thousands of protesters.

Political and economic tensions in the territory have been rising recently, fanned by Beijing's release of a controversial white paper asserting its control.

City activists accuse China of reneging on its "one country, two systems" pledge that was a condition of Hong Kong's return in 1997.

Hong Kong enjoys a high level of economic autonomy, but Beijing's critics say it is encroaching on judicial and political freedoms. On Friday, 1,800 of the city's lawyers, dressed in black, marched in protest.

Bigger flash points are likely over the next few months before a decision over how Hong Kong will elect its next chief executive, the city's highest office.

Pro-democracy activists want Hong Kong residents to elect the chief executive directly. Beijing is said to favor a process that would allow it to screen candidates.

The most visible pro-democracy group -- Occupy Central With Love and Peace -- conducted an unofficial election of its own this month, drawing nearly 790,000 voters, or almost a quarter of the electorate.

The group is also planning a demonstration and other acts of civil disobedience designed to snarl traffic and disrupt operations in the central business district.

Related: Why Occupy Wall Street fizzled

Although they share a moniker, Hong Kong's "Occupy" supporters are not affiliated with the protest movement that got its start in Manhattan's Zuccotti Park. The groups share concerns over rising income inequality, but the Hong Kong group's immediate goal is to secure full voting rights.

"Hong Kong people really want to show to China, to the whole world, that we are determined to have full democracy," organizer Benny Tai told CNN on Monday.

The group's plan to "occupy Central" has set many in the city's establishment on edge.

Hong Kong affiliates of the big four accounting firms -- Deloitte, Ernst & Young, PricewaterhouseCoopers and KPMG -- placed an advertisement in local newspapers last week, trumpeting their opposition to the movement.

"We are concerned that Occupy Central will have a negative effect on the rule of law, social order and the economy of Hong Kong," they said in the ad. "We worry that this would cause international and local investors to relocate their Hong Kong's headquarters or even relocate their businesses."

The highly unusual public intervention by multinational companies in local politics drew widespread criticism. The Financial Times reported that the firms' head offices were not made aware of the plan prior to publication.

Paul Gillis, a professor at Peking University's Guanghua School of Management, wrote on his blog that the "arrogance of the firms is stunning" and the decision would diminish their brand value.

Some employees of the accounting firms shot back Monday -- taking out an ad of their own in support of Occupy Central.

First Published: June 30, 2014: 7:02 AM ET

The tiny nation of Bhutan started measuring "gross national happiness" in the 1970s. More recently, public experts have started to tout the importance of measuring citizens' well-being in addition to GDP.

The tiny nation of Bhutan started measuring "gross national happiness" in the 1970s. More recently, public experts have started to tout the importance of measuring citizens' well-being in addition to GDP.

Sponsors are distancing themselves from Luis Suarez after he bit another player during a World Cup game this week.

Sponsors are distancing themselves from Luis Suarez after he bit another player during a World Cup game this week.  Google co-founder Sergey Brin rocks Google Glass.

Google co-founder Sergey Brin rocks Google Glass.  Divorce doesn't put an end to your liability for joint debt accrued while you were married, even if the court rules your ex should pay it. If he or she dies before doing so, then creditors can come after you.

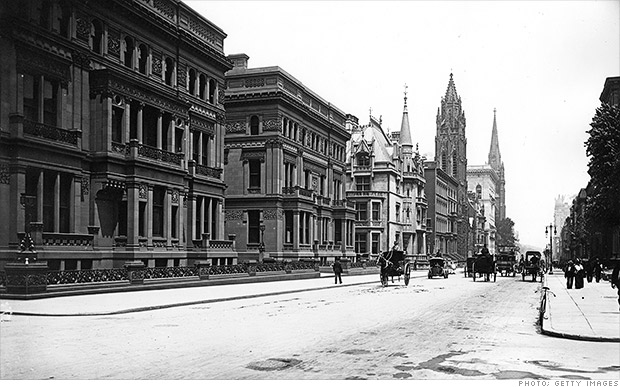

Divorce doesn't put an end to your liability for joint debt accrued while you were married, even if the court rules your ex should pay it. If he or she dies before doing so, then creditors can come after you.  In 90% of cases, the family fortune is squandered by the third generation. Here, New York City mansions built by the Vanderbilt family -- a classic example of wealth made and lost.

In 90% of cases, the family fortune is squandered by the third generation. Here, New York City mansions built by the Vanderbilt family -- a classic example of wealth made and lost.  Muhammad Yunus, founder of Grameen Bank, cuts the ribbon at the U.S. Training Institute's opening.

Muhammad Yunus, founder of Grameen Bank, cuts the ribbon at the U.S. Training Institute's opening.  Kathy Lyons owns a franchise in Seattle and says that her business might not survive the transition to a $15 minimum wage.

Kathy Lyons owns a franchise in Seattle and says that her business might not survive the transition to a $15 minimum wage.  Chuck Stempler, who owns AlphaGraphics franchises in Seattle, said the transition to a $15 minimum wage could cost jobs.

Chuck Stempler, who owns AlphaGraphics franchises in Seattle, said the transition to a $15 minimum wage could cost jobs.  Eric Schneider emptied his 401(k) to start a specialty coffee and tea shop with his wife Nancy in 2012. Two years later, the business is set to log a profit.

Eric Schneider emptied his 401(k) to start a specialty coffee and tea shop with his wife Nancy in 2012. Two years later, the business is set to log a profit.

Online TV startup Aereo will soon hear its fate from the Supreme Court. Brian Stelter has covered Aereo from the beginning.

Online TV startup Aereo will soon hear its fate from the Supreme Court. Brian Stelter has covered Aereo from the beginning.

Actress and producer Mindy Kaling was the host at an event geared toward getting more young girls interested in tech.

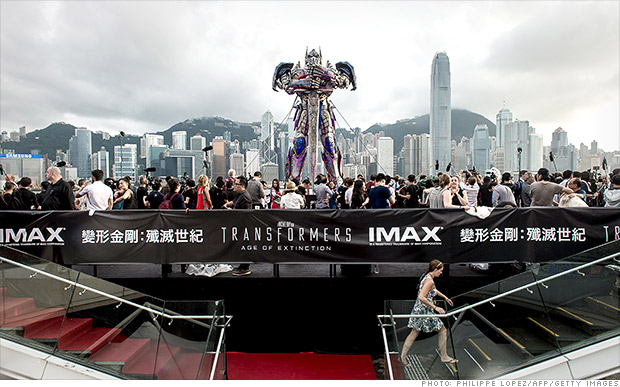

Actress and producer Mindy Kaling was the host at an event geared toward getting more young girls interested in tech.  Paramount was given access to a Chinese national park to film the latest installment in the Transformers' franchise.

Paramount was given access to a Chinese national park to film the latest installment in the Transformers' franchise.  U.S. stocks ended mixed Thursday.

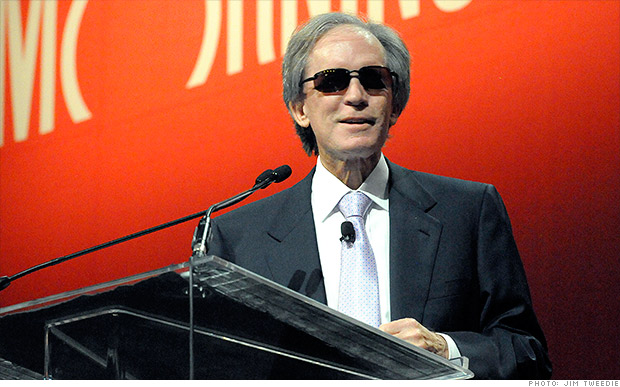

U.S. stocks ended mixed Thursday.  Bill Gross hit the stage June 19, 2014 at the Morningstar Investor Conference wearing sunglasses and trying to convince attendees his company is fine.

Bill Gross hit the stage June 19, 2014 at the Morningstar Investor Conference wearing sunglasses and trying to convince attendees his company is fine.  If your parents die before paying off their debts, you may worry creditors will come after you. Usually they can't, but not always. The rules are complex and much depends on state law.

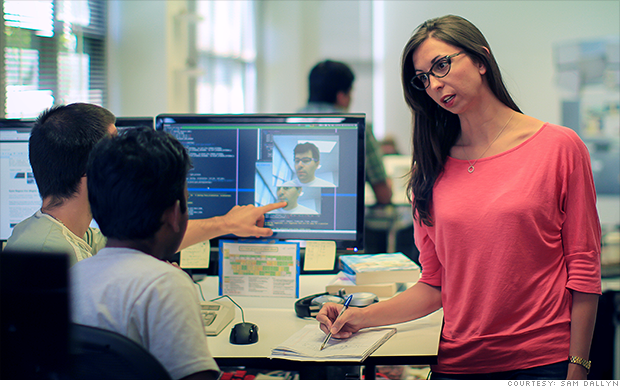

If your parents die before paying off their debts, you may worry creditors will come after you. Usually they can't, but not always. The rules are complex and much depends on state law.  Kate Doerksen looks at Ditto's site with an employee.

Kate Doerksen looks at Ditto's site with an employee.

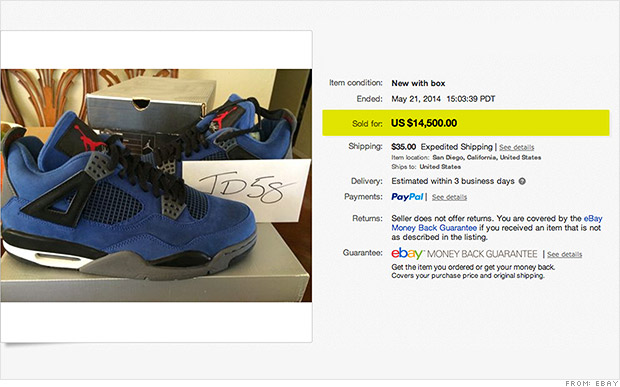

Rare "Eminem" Air Jordan 4's sold in May for an eye-popping price. But fans weren't fazed, as sneaker resales get hotter.

Rare "Eminem" Air Jordan 4's sold in May for an eye-popping price. But fans weren't fazed, as sneaker resales get hotter.  A hot shoe release this month: The Nike Air Jordan 6 Retro Celebration Cigar model.

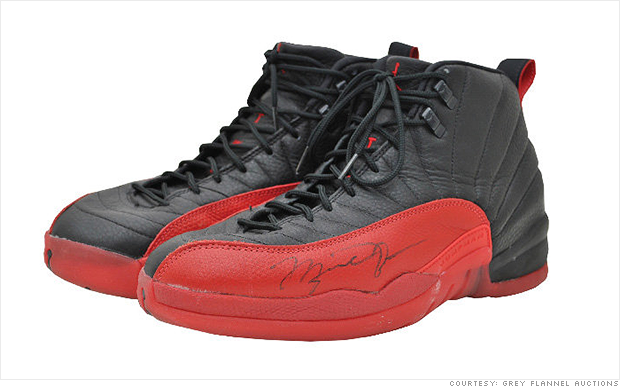

A hot shoe release this month: The Nike Air Jordan 6 Retro Celebration Cigar model.  Collectors call these the "Holy Grail" of limited edition sneakers. Game-worn and signed by Michael Jordan himself, a pair sold in December for $105,000.

Collectors call these the "Holy Grail" of limited edition sneakers. Game-worn and signed by Michael Jordan himself, a pair sold in December for $105,000.  These "Back to the Future" boots don't lace themselves like in the movie, but Nike's reportedly working on it for 2015.

These "Back to the Future" boots don't lace themselves like in the movie, but Nike's reportedly working on it for 2015.