Workers apply stucco to an under construction at the Toll Brothers Inc. Jupiter Country Club housing development in Jupiter, Florida in August 2014.

NEW YORK (CNNMoney)

There is so much data on the economy now, it is hard to figure out what is most important. Last week alone exemplified the flood of numbers: the Census Bureau, Federal Reserve and Labor Department released a variety of economic data points.

The big news makers -- employment, inflation and gross domestic product -- are always important statistics, but if you really want to know where things are headed, there are a few lesser-known indicators that give a fuller picture of the economy's health.

To make some sense of it all, CNNMoney surveyed numerous economist. According to the experts, keep an eye on these three things.

1. People's spending: Shoppers have a big impact on the economy. Consumption makes up over two-thirds of the America's gross domestic product. The Great Recession made people a lot more cautious about buying things. And when people aren't buying, that also hurts company profits and jobs.

"You can't sustain strong economic growth without the consumer leading the way," said Sal Guatieri, senior economist at BMO Capital Markets in Toronto.

The question is whether buying is back.

The best way to gauge that is the monthly Personal Consumption Expenditures (PCE) index.

Related: Are you a home buying genius?

At the height of the recession in 2009, PCE decreased, and it still is not back to its pre-recession levels.

What most economists -- and businesses -- want to see if steadily increasing spending. But so far in 2014, there have been three months where PCE has dropped, including July. That's worse than 2013 where the PCE increased (or at least remained level) every month.

Bottom line: Not back yet

2. Home buying and building: The housing collapse was at the center of the recession. The slow recovery of the housing market serves as a microcosm of the economy's tepid comeback.

"Home ownership has historically been the single largest trigger to consumer spending," said Diane Swonk, chief economist at Mesirow Financial in Chicago.

People who buy homes tend to buy more of other products than non-buyers, which suggests that home buying can trigger a positive ripple effect on personal spending and jobs, Swonk says.

Economists are watching a data point known as "housing starts."

Single-family housing starts in July numbered 656,000, or about 10% higher than the same time last year, according to the Census Bureau. Still, the number of these housing starts is 50% below a typical level, says Robert Denk, senior economist at the National Association of Home Builders in Washington D.C.

Related: Housing market is a 'crapshoot'

A more normal level of housing starts would be about 1.3 million, the average between 2000 and 2003, Denk says.

"The recovery truly can't be considered complete until housing gets back on track," Denk says. "[Housing] generates jobs and it still really is that sector of the economy that hasn't fully recovered, in fact it's only halfway back."

Bottom line: Not back yet

Related: Private sector jobs are coming back

3. Manufacturing: America might be known for Silicon Valley more than steel these days, but the country still makes a lot of products.

Another indicator that holds implications for the greater economy is the PMI, an acronym for the wonky-sounding Purchasing Managers' Index (that term was actually abandoned in 2001). Created by the Institute for Supply Management, the PMI gauges manufacturing levels across the country, taking several factors into consideration, including employment and inventory levels.

In a positive sign for the recovery, the PMI hit a 12-month high in August at 59%, according to ISM. The average PMI at the recession's peak in 2009 was 46.4%. Thus far in 2014, the PMI has averaged 54.9%, signaling a healthy gain in manufacturing during the recovery.

There are some concerns that the really strong U.S. dollar could hurt manufacturing, since it makes American goods a lot more expensive to people in Europe and other parts of the world, but so far there doesn't seem to be an impact.

Bottom line: Good manufacturing rebound

First Published: September 23, 2014: 8:08 AM ET

PayPal will become a separate company after separating from eBay.

PayPal will become a separate company after separating from eBay.

In towns like Austin, there's lots of new Texans moving in from more expensive markets.

In towns like Austin, there's lots of new Texans moving in from more expensive markets.  Ello doesn't require your picture or your name to sign up.

Ello doesn't require your picture or your name to sign up.

Apple's new Health app in action.

Apple's new Health app in action.  Marc Andreessen is worried about high burn rates at Silicon Valley startups.

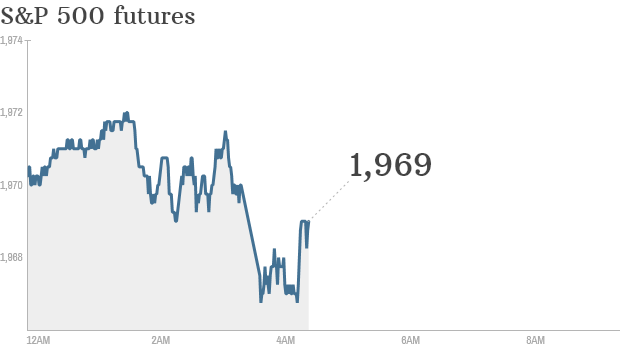

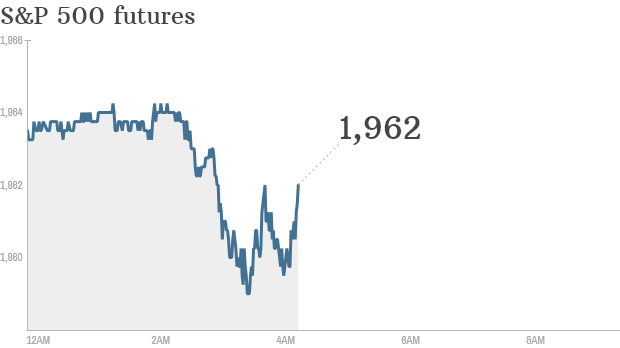

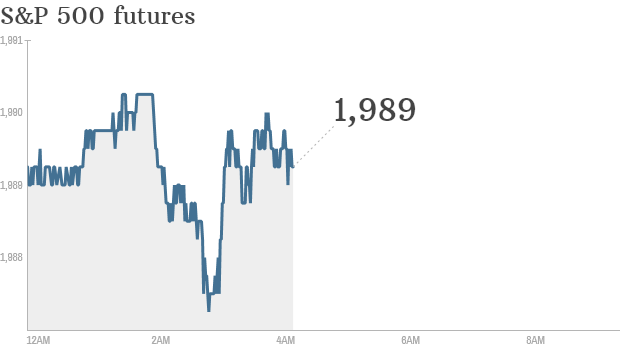

Marc Andreessen is worried about high burn rates at Silicon Valley startups.  Click chart for in-depth premarket data.

Click chart for in-depth premarket data.

Click chart for in-depth premarket data.

Click chart for in-depth premarket data.  Zero Hedge posts are submitted under the pseudonym "Tyler Durden," the fictional character played by Brad Pitt in the 1999 film "Fight Club."

Zero Hedge posts are submitted under the pseudonym "Tyler Durden," the fictional character played by Brad Pitt in the 1999 film "Fight Club."  Walmart will start offering checking accounts to customer in October.

Walmart will start offering checking accounts to customer in October.  Coca-Cola is going on a diet. Big Soda has vowed to reduce calories.

Coca-Cola is going on a diet. Big Soda has vowed to reduce calories.  Mylan's purchase of part of Abbott Laboratories' non-US business is one tax 'inversion' deal now in the spotlight.

Mylan's purchase of part of Abbott Laboratories' non-US business is one tax 'inversion' deal now in the spotlight.  Celebrities and mere mortals alike are known to covet Jimmy Choo shoes.

Celebrities and mere mortals alike are known to covet Jimmy Choo shoes.  Malaysian designer Jimmy Choo co-founded the eponymous luxury retail brand in 1996.

Malaysian designer Jimmy Choo co-founded the eponymous luxury retail brand in 1996.  Workers apply stucco to an under construction at the Toll Brothers Inc. Jupiter Country Club housing development in Jupiter, Florida in August 2014.

Workers apply stucco to an under construction at the Toll Brothers Inc. Jupiter Country Club housing development in Jupiter, Florida in August 2014.

Stocks hit fresh records last week and the S&P 500 is up nearly 9% this year.

Stocks hit fresh records last week and the S&P 500 is up nearly 9% this year.  Who's hungry? Insider trader ate his Post-it notes after passing stock tips.

Who's hungry? Insider trader ate his Post-it notes after passing stock tips.

As federal spending on the elderly and interest on the debt is set to grow, spending on children will decline in most areas, including for K-12 education and nutrition, a new report from the Urban Institute found.

As federal spending on the elderly and interest on the debt is set to grow, spending on children will decline in most areas, including for K-12 education and nutrition, a new report from the Urban Institute found.  Bob McDonald, the new VA secretary, spoke on Capitol Hill this week.

Bob McDonald, the new VA secretary, spoke on Capitol Hill this week.