Michael Granillo speaks to a doctor at Northridge Hospital Medical Center, which takes ER appointments.

NEW YORK (CNNMoney)

"I was in so much pain I wanted to be taken care of now," said Granillo, 34, who lives in Reseda, Calif., and runs a hot dog cart business.

On a recent Wednesday morning, he woke up feeling even worse. This time, Granillo's wife, Sonya, tried something different: Using a new service offered by the hospital, she was able to make an ER appointment online, using her mobile phone.

When they arrived at the hospital, he was seen almost immediately.

"That was my last resort and it worked," she said. "He would have probably been at home in pain if not for the service."

In an era of increased competition driven by the nation's health law, hospitals in California and around the country are hoping online ER appointments will help attract patients anxious to avoid long waits in a crowded and often chaotic environment.

"It makes for a happier camper," said Susan Dubuque, a national expert in hospital marketing. "When it comes to health care, consumers want more control over everything."

The system, adopted by Northridge and other hospitals in the Dignity Health chain about a year ago, is intended only for patients who don't have life-threatening or debilitating emergencies. To check in online, patients must explain the reason for their visit and check a box that they can wait for treatment.

Patients having chest pain or trouble breathing, for instance, are instructed to call 911 or go directly to an ER. Those with an ankle sprain or a fever, for instance, might be able to make an appointment.

When patients get to the hospital, they still may be bumped by more seriously ill patients.

The approach makes business sense for hospitals because it lets medical staff know who may be coming through the door and it makes patients more comfortable, hospital executives say.

Patients want to access health care the same way they do services in other industries, such as retail or travel, said Chris Song, a spokesman for InQuicker, a Nashville-based company that offers the online scheduling in California and 25 other states.

"When is the last time someone bought plane tickets at the gate?" he said.

Related: Medicare payment rates: $15,000 for one hospital, $26,000 for another

Some critics say the online check-in system may be convenient but is not necessarily cost-effective. If the country wants to decrease health care costs, patients need to be treated at the right place at the right time, said Del Morris, president of the California Academy of Family Physicians. Patients who can make appointments should do so at their doctors' offices, he said.

"Emergency rooms are there to take care of people who have emergencies," said Morris, medical director of the Stanislaus County Health Services Agency.

Related: Hospitals face major government crackdown for injuring patients

The Dignity chain says roughly 12,000 patients have scheduled visits for emergency rooms at hospitals in California, Arizona and Nevada. Recently, Dignity stepped up marketing, with billboards, print advertisements and online and radio spots.

On the day of his appointment at Northridge, Granillo winced and shifted uncomfortably in the ER exam room. After a CT-scan, doctors told the couple that Granillo had a very serious condition-- lymphoma, a type of cancer.

Stephen Jones, the ER's medical director, said some patients who come in through the appointment service probably should be seen by a primary care doctor but either don't have one or can't get a timely appointment. Others, like Granillo, shouldn't wait for care, he said.

Dignity Health, which is also offering the online reservations at urgent care centers and doctors' offices, hopes that the new service will minimize wait times and boost patient satisfaction scores, said Page West, chief nursing officer. Under the Affordable Care Act, Medicare reimbursements for hospitals are tied to results on the patient surveys.

Others say hospitals need to do more to fix the emergency room process in which people show up and wait for hours, said Bridget Duffy, chief medical officer at Vocera Communications in San Jose and an expert in the patient experience. Besides offering online appointments, hospitals need to assess patients more quickly, improve communication with them and better manage their pain.

As it stands, Duffy said, "It's ridiculous ... it's like herding cattle."

First Published: July 23, 2014: 8:11 AM ET

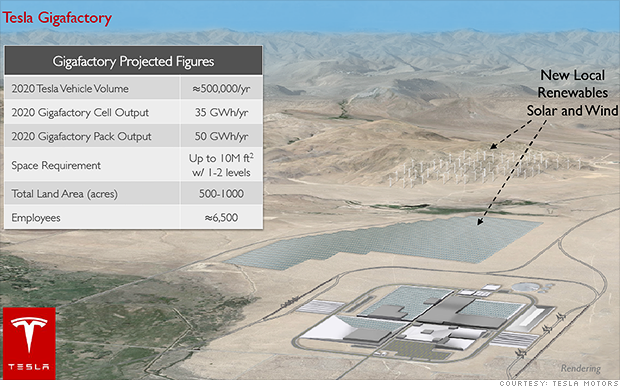

A rendering of Tesla's planned Gigafactory.

A rendering of Tesla's planned Gigafactory.

Brian Cornell left his CEO job at PepsiCo to take the top job at Target.

Brian Cornell left his CEO job at PepsiCo to take the top job at Target.  Gallery: Best-loved cars in America

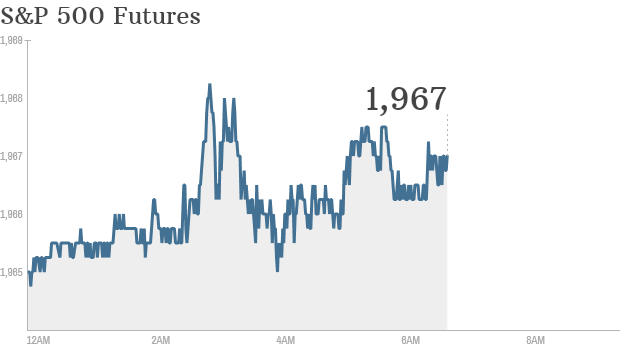

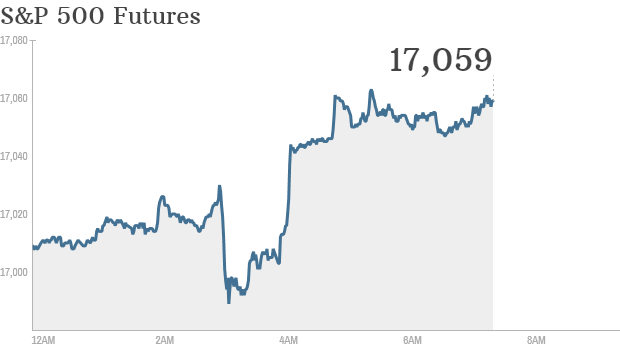

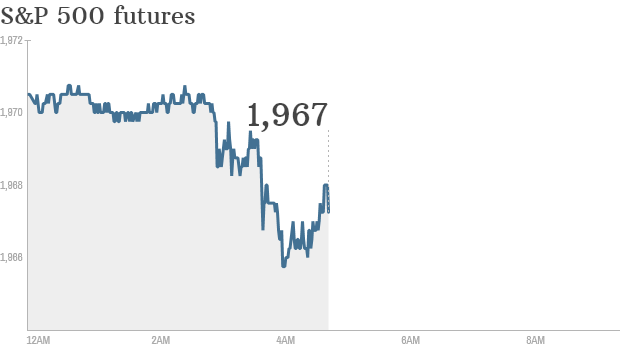

Gallery: Best-loved cars in America  Click on chart to track premarkets

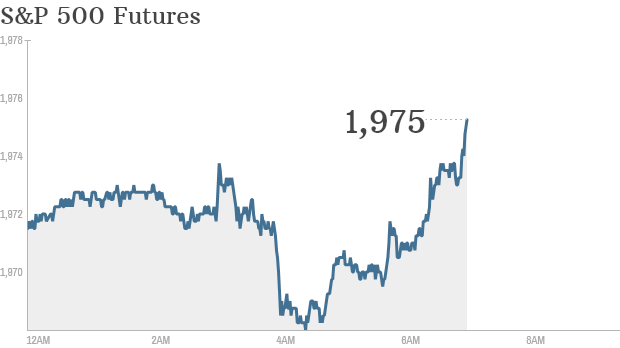

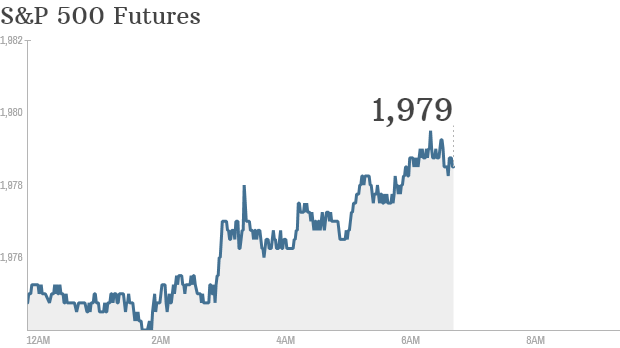

Click on chart to track premarkets  Click on chart to track premarkets

Click on chart to track premarkets

Delta is going to stop charging passengers for in-flight entertainment.

Delta is going to stop charging passengers for in-flight entertainment.  Per capita business travel spending in China still under $200 -- far less than the $800 U.S. average.

Per capita business travel spending in China still under $200 -- far less than the $800 U.S. average.  Click on chart to track premarkets

Click on chart to track premarkets  Family Dollar is being acquired by dollar-store rival Dollar Tree for $8.5 billion.

Family Dollar is being acquired by dollar-store rival Dollar Tree for $8.5 billion.

Quant trader Elie Galam at the Panorama Partners' New York City office. He is not a Wolf of Wall Street.

Quant trader Elie Galam at the Panorama Partners' New York City office. He is not a Wolf of Wall Street.  Rideshare app Lyft, known for the pink mustaches on car grills, will launch in New York on Friday

Rideshare app Lyft, known for the pink mustaches on car grills, will launch in New York on Friday

Detroit's looming water shutoffs spark a social media campaign and an app to connect donors with residents behind on their bills.

Detroit's looming water shutoffs spark a social media campaign and an app to connect donors with residents behind on their bills.  Target hack victims were directed to Experian for protection. But that company has leaked your data too.

Target hack victims were directed to Experian for protection. But that company has leaked your data too.

GM record 30 million recalls cost it $1.3 billion in the second quarter, including $400 million it set aside to pay victims of the faulty ignition switch, seen being repaired here.

GM record 30 million recalls cost it $1.3 billion in the second quarter, including $400 million it set aside to pay victims of the faulty ignition switch, seen being repaired here.  Michael Granillo speaks to a doctor at Northridge Hospital Medical Center, which takes ER appointments.

Michael Granillo speaks to a doctor at Northridge Hospital Medical Center, which takes ER appointments.  Click on chart to track premarkets

Click on chart to track premarkets  Click on chart to track premarkets

Click on chart to track premarkets  The shooting down of Malaysia Airlines Flight 17 in eastern Ukraine may persuade Europe to take a tougher line with Moscow over its support for separatist rebels.

The shooting down of Malaysia Airlines Flight 17 in eastern Ukraine may persuade Europe to take a tougher line with Moscow over its support for separatist rebels.  Chinese authorities have shut down an American-owned meat processor in Shanghai that was supplying several big name chains.

Chinese authorities have shut down an American-owned meat processor in Shanghai that was supplying several big name chains.  Carlos Slim, the world's second richest man, is advocating a three-day work week.

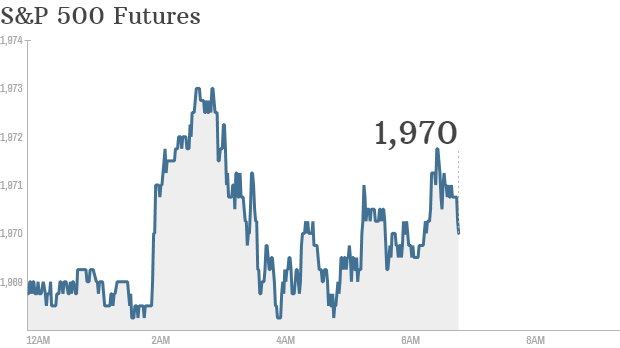

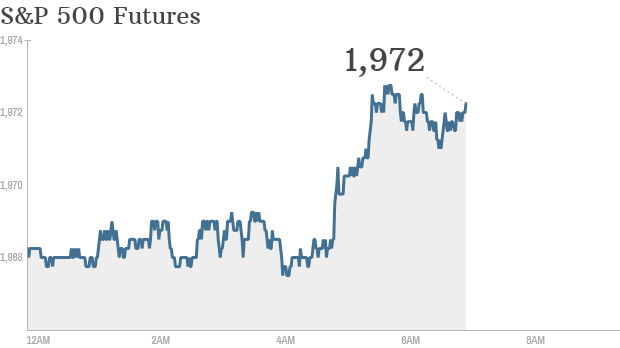

Carlos Slim, the world's second richest man, is advocating a three-day work week.  Click on chart for more premarket data.

Click on chart for more premarket data.  Shares slipped for Pall Mall producer Reynolds American after a jury awarded a smoker's widow $23.6 billion.

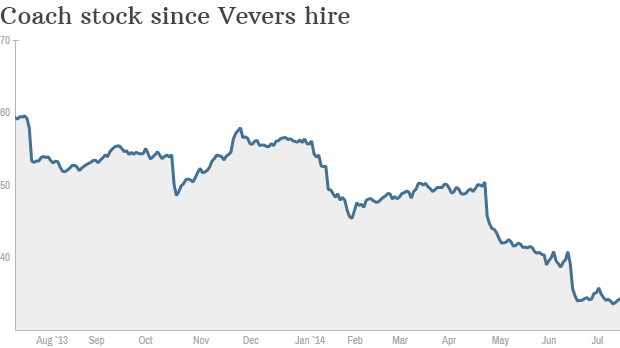

Shares slipped for Pall Mall producer Reynolds American after a jury awarded a smoker's widow $23.6 billion.  Coach has hired Stuart Vevers to try to revive a brand that has been around since 1941.

Coach has hired Stuart Vevers to try to revive a brand that has been around since 1941.

Four months after a Malaysia Airlines plane goes missing, another one of its passenger jets is shot out of the sky.

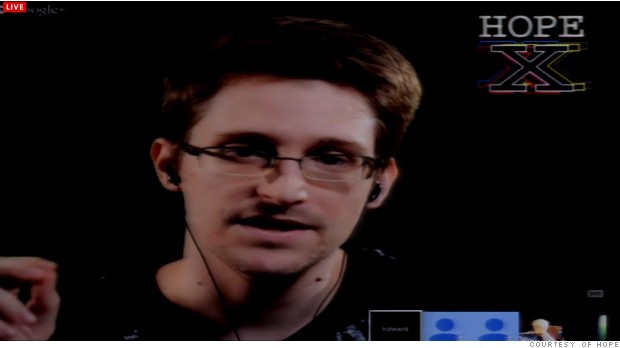

Four months after a Malaysia Airlines plane goes missing, another one of its passenger jets is shot out of the sky.  Ex-NSA contractor Edward Snowden, exiled in Russia, speaks via video connection to a crowd of hackers in New York City.

Ex-NSA contractor Edward Snowden, exiled in Russia, speaks via video connection to a crowd of hackers in New York City.