The global economy is facing a 'sink or swim' situation now that central banks have done all they can to pump liquidity into the markets.

DAVOS, Switzerland (CNNMoney)

This week the European Central Bank unveiled a massive stimulus program -- worth $1.3 trillion -- to lift the region out of its economic malaise.

It was the latest in a long line of stimulus measures from central banks around the world. But it will only work if everybody else follows through.

European politicians and policy makers must now make decisive moves to increase productivity, investment and growth, which can involve reforming labor market rules, promoting entrepreneurship and tweaking tax codes.

"We all have a job to do," said ECB member Benoit Coeure during a panel discussion on Saturday at the World Economic Forum in Davos. "We have done our part. Others have to do their part."

The stimulus certainly buys more time for European governments to press ahead with economic reforms.

But they had better move quickly! The head of the International Monetary Fund, Christine Lagarde, told CNN this week that "inaction" is currently the biggest global risk.

Related: See complete coverage from Davos

But as the ECB money starts sloshing around the financial system and flowing into other parts of the world, concerns have been raised about reckless risk taking and financial instability.

Mark Carney, governor of the Bank of England, warned that markets shouldn't assume central banks will always come to the rescue when asset prices fall.

Carney also said he was expecting more market volatility and cash crunches to emerge in different markets as diverging central bank policies in Europe, Japan and the U.S. lead to unexpected shifts in the flow of money.

In short, central banks are watching out for these risks, but investors had better be careful too.

ECB member Benoit Coeure (left) with Bank of England governor Mark Carney at the World Economic Forum.

There's also the distinct possibility that the new ECB program will fuel further wealth inequality, which could lead to growing social division.

Both Carney and Coeure recognized that central bank stimulus measures tend to benefit people who already have investments and assets, while hurting everyday savers.

"Monetary policy always has distributional consequences," said Carney.

Billionaire investor George Soros also warned about the issue this week.

"My main concern is that [the ECB stimulus] will make the divergence between the rich and poor bigger," he said, during a separate Davos event.

But growing inequality isn't a sure thing.

"You can have the best of both worlds" if countries implement programs to support the unemployed and improve the labor market, said Coeure.

But then again, these financial heavyweights don't have crystal balls to see the future.

In fact, as they try to predict what to expect in 2015, they are humbled by the fact that they did not predict falling oil prices, a crisis in Ukraine, a fall-out with Russia and a rise in the extremist group ISIS in 2014.

"I hope we're going to be a little better [with our predictions] this time," said Laurence Fink, CEO of BlackRock (BLK), who moderated the Davos panel on Saturday.

When it comes to expecting the unexpected, the panelists agree that technology has the power to reshape global dynamics.

For example, fracking technology created a glut of oil supplies and drove crude prices below $50 per barrel, causing a range of knock on effects around the world that no one could have predicted.

"Technology ... is under appreciated, at least by politicians, as to how [it's] transforming their societies," said Fink.

First Published: January 24, 2015: 2:48 PM ET

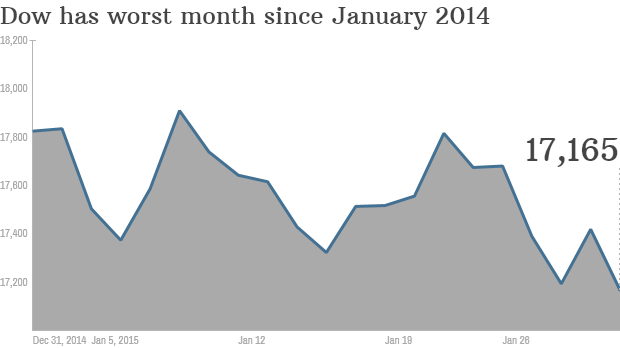

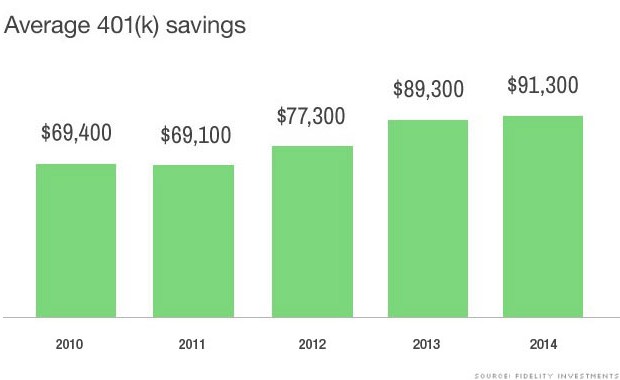

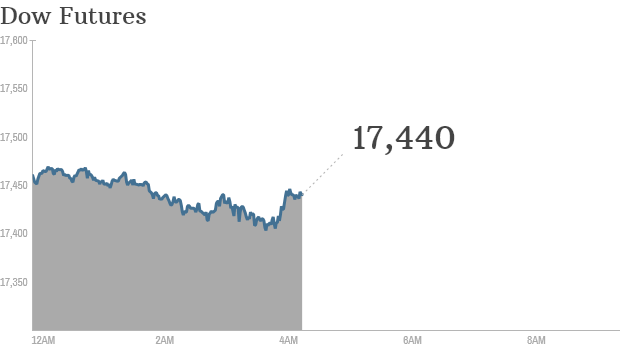

Stocks have been having a pretty bad 2015 so far.

Stocks have been having a pretty bad 2015 so far.

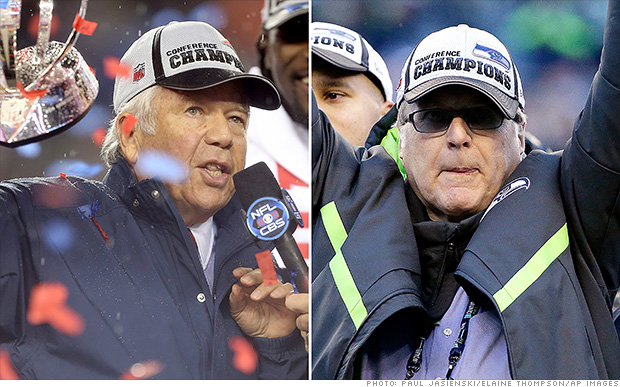

Bob Kraft, left, and Paul Allen, right, owners of the two Super Bowl teams, made their fortunes in very different ways.

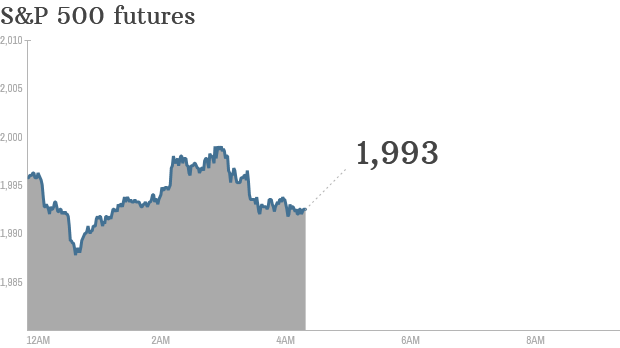

Bob Kraft, left, and Paul Allen, right, owners of the two Super Bowl teams, made their fortunes in very different ways.  Click on chart for more premarket data.

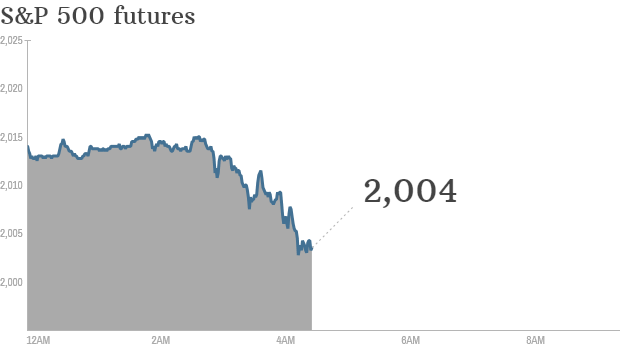

Click on chart for more premarket data.

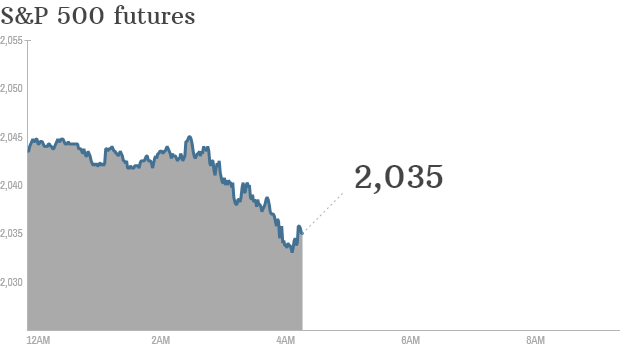

Click chart for in-depth premarket data.

Click chart for in-depth premarket data.

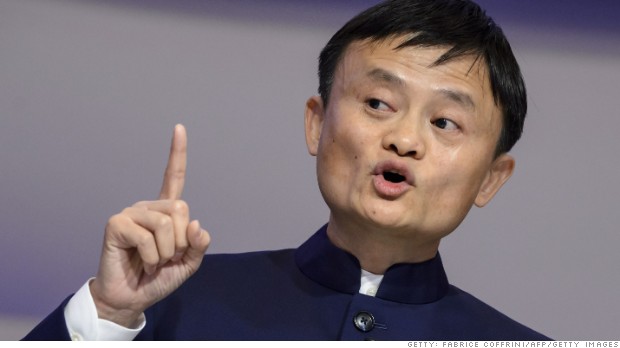

Alibaba co-founder Jack Ma has called counterfeits a "cancer."

Alibaba co-founder Jack Ma has called counterfeits a "cancer."  Click chart for in-depth premarket data.

Click chart for in-depth premarket data.  The Winklevoss twins at ETF.com's Inside ETFs Conference.

The Winklevoss twins at ETF.com's Inside ETFs Conference.  Many parts of Europe are on sale now that the euro is at an 11-year low against the U.S. dollar.

Many parts of Europe are on sale now that the euro is at an 11-year low against the U.S. dollar.  U.S. stocks closed mixed Friday.

U.S. stocks closed mixed Friday.  Here's a peek at PWC's custom-built corporate hacking simulator.

Here's a peek at PWC's custom-built corporate hacking simulator.  The global economy is facing a 'sink or swim' situation now that central banks have done all they can to pump liquidity into the markets.

The global economy is facing a 'sink or swim' situation now that central banks have done all they can to pump liquidity into the markets.  ECB member Benoit Coeure (left) with Bank of England governor Mark Carney at the World Economic Forum.

ECB member Benoit Coeure (left) with Bank of England governor Mark Carney at the World Economic Forum.  The strong start for "American Sniper" was boosted by the Oscar nomination of star Bradley Cooper.

The strong start for "American Sniper" was boosted by the Oscar nomination of star Bradley Cooper.  Emma Watson is a celebrity spokesperson for the HeForShe campaign.

Emma Watson is a celebrity spokesperson for the HeForShe campaign.

Sports Illustrated, which boasts a long history of indelible photos, laid off all six of its staff photographers this week.

Sports Illustrated, which boasts a long history of indelible photos, laid off all six of its staff photographers this week.  Google will sell wireless service directly to customers over Sprint and T-Mobile's networks, according to multiple reports.

Google will sell wireless service directly to customers over Sprint and T-Mobile's networks, according to multiple reports.

Cybersecurity is a major threat.

Cybersecurity is a major threat.

Chinese Premier Li Keqiang spoke this week at the World Economic Forum in Davos, Switzerland.

Chinese Premier Li Keqiang spoke this week at the World Economic Forum in Davos, Switzerland.  "I am Charlie" is the unity cry that spread in the wake of the attack on Charlie Hebdo.

"I am Charlie" is the unity cry that spread in the wake of the attack on Charlie Hebdo.  Click on the chart for more premarket data

Click on the chart for more premarket data  NFL owners like Paul Allen, seen here cheering his team's playoff win on Sunday, have a lot to cheer about.

NFL owners like Paul Allen, seen here cheering his team's playoff win on Sunday, have a lot to cheer about.