Pet med

Written By limadu on Kamis, 31 Oktober 2013 | 05.32

One big happy brokerage

From left: CEO Rodger Riney and Lindsay Morrison conduct a live chat; employees celebrate Hawaiian shirt day; Scottrade's team at a charity event in St. Louis.

(Fortune)

Scottrade CEO and founder Rodger Riney expects his employees to have fun at work. But on April Fools' Day -- during the height of the flash-mob craze -- even he couldn't have guessed that his staff would surprise him with a dance routine to Taio Cruz's "Dynamite."

In a video posted on YouTube, the wide-eyed look on Riney's face serves as a reward for the month of rehearsals put in by a troupe of a few dozen financial services professionals.

True, flash mobs don't happen every day at Scottrade. Celebrations and camaraderie, however -- including free birthday lunches, ice cream socials, cook-offs, and a recent carnival for employees and their families -- are routine at a company that has appeared on Fortune's 100 Best Companies list for the past six years.

Fewer FBI agents, fighter jets from 2014 cuts

WASHINGTON (CNNMoney)

These are just some of the consequences of budget cuts that government agencies are predicting could happen next year.

In mid-January, another round of bone-deep cuts are scheduled to be rolled out. They are part of the sequester, or spending cuts that went into effect in March and will last through the year 2022.

"What we're going to see is really tough decisions, really cutting into the bone of programs," said Scott Klinger, director of revenue and spending policies at the Center for Effective Government, a budget watchdog group. "The belt tightening, the deferred maintenance, the tapping of rainy day funds -- it's all been done already."

A group of lawmakers met on Wednesday to begin talks about funding the rest of the 2014 fiscal year through September, and the panel could recommend ways to replace the sequester or mitigate its hit. The panel meets again in two weeks.

Related: Aiming for more than bupkis on the budget

The March cuts of $80 billion resulted in 57,000 fewer kids in early childhood education programs, delays in federal criminal cases and furloughs for more than 650,000 federal defense workers. The January round of cuts will total $109 billion.

Senate Democrats want to get rid of sequester.

House Republicans want to keep the sequester but spare defense. And federal agencies are trying to figure out what they will have left that won't cut their mission to the core.

Related: Spending cuts are hurting the economy

At the Pentagon, another year of sequester would mean that Air Force couldn't afford four or five of the 19 F-35 fighter jets requested for 2014, principal deputy Air Force secretary William LaPlante told a congressional panel last week.

"The Air Force, after sequestration, is going to be smaller, less capable, less ready and less flexible -- that's the bottom line," LaPlante said.

The National Institutes of Health estimates that 640 fewer research projects got funded in 2013 compared to 2012. That could happen again in 2014, warned NIH Director Francis Collins in a speech.

"Which of those would have been the next breakthrough in cancer?" he said at a forum on national health. "Which of those investigators would have been the Nobel Prize winner we would celebrate in 20 years? We'll never know," he said.

FBI Director James Comey said last month that his agency stopped training new agents at the FBI Academy in Quantico, Va. When the new round of sequester rolls out, the FBI would have to cut $800 million from its budget, and instead of hiring, it will have to furlough employees.

"That cupboard is bare. I can't avoid it this year," Comey said.

-- CNN's Deirdre Walsh and Evan Perez contributed to this report. ![]()

First Published: October 31, 2013: 7:15 AM ET

The hottest job skill is...

Written By limadu on Rabu, 30 Oktober 2013 | 05.33

NEW YORK (CNNMoney)

What is it? Fluency in a foreign language.

Translators and interpreters are expected to be one of the 15 fastest growing occupations in the nation, according to the Department of Labor.

Roughly 25,000 jobs are expected to open up for interpreters (who focus on spoken language) and translators (who focus on written language), between 2010 and 2020, the Department of Labor estimates. That represents 42% growth for the field and does not include the military, which is also recruiting ferociously for more people.

In the last week alone, roughly 12,000 jobs posted on Indeed.com included the word "bilingual."

Amazon, for example, wants to hire a Brazilian Portuguese translator for its customer service team in Seattle. Apple is hiring technical translators who speak Korean, Mexican Spanish and Chinese.

A school district in Pasadena, Calif., is hiring Spanish, Korean, Armenian and Chinese interpreters to work part time for $40 an hour.

Related: Americans lacking in basic skills

Nationwide, workers in this field earn a median salary of $43,000 a year.

Far higher salaries go to people who work in the intelligence community on behalf of the military, the State Department, CIA, FBI or government contractors. These jobs can pay well into the six figures, as workers are required to pass high-level security clearances and enter dangerous situations.

"The government needs languages spoken in the Middle East and Africa. These people make the most money of all, but this is not just because of their language skills -- this is because of the high risk of the job," said Jiri Stejskal, spokesman for the American Translators Association. "They work in war zones. They may have a $200,000 salary but it's because they're willing to get shot at."

Not willing to put your life on the line? High salaries are also available to translators and interpreters who specialize in legal, medical, technical or scientific knowledge.

Which languages offer the highest returns? In government jobs, it's middle eastern languages like Arabic, Farsi and Pashto (Afghani). In the private sector, it's Scandinavian and Asian languages that pay.

In contrast, Spanish is the second most common language in the United States after English, and because it is so prevalent, it offers the lowest return.

Related: The best job you never thought of

Most interpreters and translators work on a freelance basis, which can be both a blessing and a curse. The work schedule can be flexible, it can be unsteady and come without benefits.

"Since the majority of people in our field work as independent contractors and run their own business, the volume of work of course is subject to fluctuations," said Dorothee Racette, a German-English translator and president of the American Translators Association. "Compensation varies a lot based on language combination, years of experience, area of specialization, and the country or region where customers are located."

Interpreters tend to get paid by the hour, half-day or day, with a range of $300 to $1,000 per day. The highest caliber interpreters are often certified by the International Association of Conference Interpreters, and can command the largest wages, Stejskal said.

Translators, on the other hand, are usually paid by the word. The average rate for translating the 30 most commonly used languages on the web was 13 cents in 2012, according to market research firm Common Sense Advisory. Rarer languages command higher per-word rates but also tend to be lower in demand.

Speed is crucial to making the highest salary. For example, good translators who can do 2,500 to 3,000 words a day, would earn $325 to $390 a day, whereas a newbie to the field may be capable of far less.

Related: Make $30 an hour, no bachelor's degree required

Kari Carapella, a senior recruiter for staffing firm Adecco, is currently trying to fill a job for an engineering translator in Big Falls, NY. The ideal candidate must not only be fluent in Japanese, but also understand electrical and mechanical engineering blueprints and documents.

"It's especially tough to fill as both the technical and translation skills must be in place," she said.

Pay starts around $30 an hour, she added. ![]()

First Published: October 30, 2013: 6:58 AM ET

Obamacare site flaws due to government's innovation problem

NEW YORK (CNNMoney)

"It's embracing 1960's era technology," former U.S. Chief Information Officer Vivek Kundra told CNNMoney. "A core issue there is a same set of problems we've seen in the past."

As the first CIO of the United States, Kundra's been credited with instituting a cloud-first policy to help make the government more efficient. It's a policy Kundra says could have saved folks building out healthcare.gov time and money.

For example, Kundra says his understanding is that the Obamacare website uses 800 servers just for authenticating users,

"You could actually have deployed that in a cloud solution without buying a single server," he said.

Related story: Security hold found in Obamacare website

Kundra has since left Washington for Silicon Valley where he serves as executive vice president of marketing at Salesforce (CRM), a company devoted to cloud technology. He said the government could have used Silicon Valley's help with the high-profile website. The site's many contractors may have contributed to the site's inefficiencies, technical errors and lack of ownership over its problems, Kundra said.

"Decisions were made to ... custom build everything rather than saying, 'Who does this best on the planet?'" Kundra noted.

But government bureaucracy rarely functions like Big Tech corporations do.

Clay Johnson, who is also a former member of President Barack Obama's technology team, said government contractors recognize that the way to make money is to throw more people at the problem rather than figuring out a way to deliver the best solution at the lowest cost.

Related story: Obamacare 'hub' back online after malfunction

"Healthcare.gov got this way not because of incompetence or sloppiness of an individual vendor, but because of a deeply engrained and malignant cancer that's eating away at the federal government's ability to provide effective online services," he wrote. "It's a cancer that's shut out the best and brightest minds from working on these problems, diminished competition for federal work, and landed us here — where you have half-billion dollar websites that don't work."

Government agencies would like nothing more than to have the best and brightest minds in the world working on healthcare.gov, Johnson said. But the best they've got to choose from are a few dozen companies.

It's a culture that calls for several cooks in the kitchen with little accountability. At a congressional hearing last week, contractors involved in the healthcare.gov roll out deflected responsibility and blamed other contractors, deadlines, and in come cases, administrative decisions.

Kundra says historically, Obama has made an effort to counter "a culture of faceless accountability," rolling out a plan to reform IT management.

But the Obamacare website ultimately fell victim to the same obstacles to innovation that many other government initiatives have in the past. ![]()

First Published: October 30, 2013: 7:24 AM ET

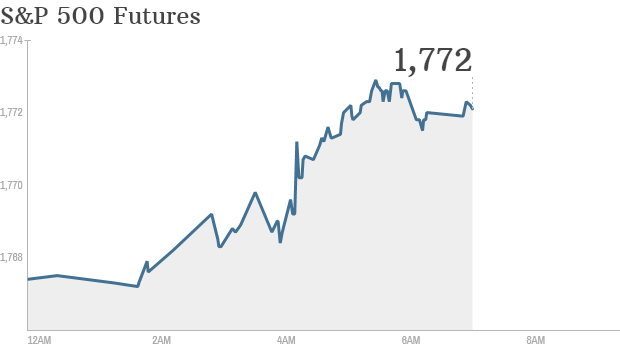

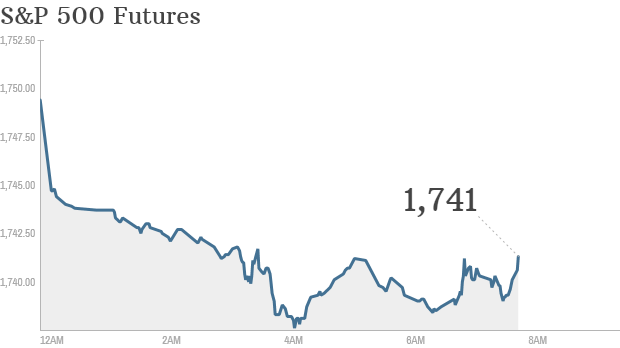

Stocks: Perky ahead of Fed decision

Click on chart to track premarkets

NEW YORK (CNNMoney)

U.S. stock futures rose, as European markets climbed to their highest levels in five years. The Fed is due to release a statement at 2 p.m. ET, following a two-day policy meeting.

Investors will parse the text for clues about when the central bank may begin scaling back its $85 billion monthly bond buying program. Many expect current stimulus efforts will be maintained for the remainder of the year.

The stimulus measures have helped buoy global markets - with the Dow Jones Industrial Average and S&P 500 trading at record highs.

Related: Fear & Greed Index surges to extreme greed

Elsewhere on the economic front, payroll processor ADP releases its monthly report on private-sector job growth at 8:15 a.m. ET. The Bureau of Labor Statistics issues the September edition of the Consumer Price Index, the government's key metric for inflation, at 8.30 a.m. ET.

Earnings season continues in full swing: Sprint (S, Fortune 500) reported a quarterly profit, after slogging through losses in earlier quarters, while Comcast (CMCSA, Fortune 500) reported declines in quarterly sales and profit.

General Motors (GM, Fortune 500) reported improved operating income and revenue as it narrowed losses in Europe and improve its profit margin in North America. Chrysler reported double-digit gains in profit and sales for the quarter. The automaker is not publicly traded, but has announced plans for an initial public offering.

Yelp (YELP) shares plunged 10% after the review site reported a wider-than expected quarterly loss and announced plans for a follow-on stock offering. On the flip side, Baidu (BIDU) shares rallied after China's largest search engine posted strong earnings and sales, and said earnings in the current quarter would easily top forecasts.

Related: Amazon is one of the most overvalued stocks

Shares of Electronic Arts (EA) jumped about 8% after the video game maker's quarterly earnings beat expectations.

Facebook (FB, Fortune 500), Expedia (EXPE) and Visa (V, Fortune 500) will report after the market close.

The Dow and S&P 500 closed at record highs Tuesday.

Meanwhile, Asian markets ended with sizable gains, with Hong Kong's Hang Seng climbing 2% and the Shanghai Composite index up 1.5%. A weaker yen helped push Japan's Nikkei up 1.2%. ![]()

First Published: October 30, 2013: 6:31 AM ET

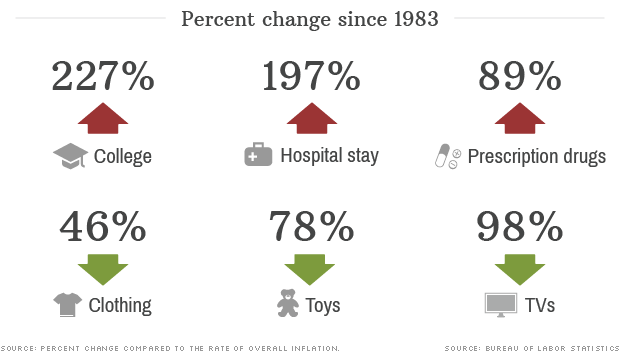

Are you paying more than your parents?

Written By limadu on Selasa, 29 Oktober 2013 | 05.32

The price of manufactured goods - think toys, clothes and electronics - has plummeted over the last 30 years, while the cost of services like health care and education has soared.

NEW YORK (CNNMoney)

It's true that sticker prices usually rise. But in relative terms, you could actually be paying a lot less than your parents did a generation ago.

For example, the price of milk has increased at a pace that's 9% slower than the overall level of inflation since 1983, according to the Bureau of Labor Statistics.

Meanwhile, some other things will cost you a lot more than the previous generation paid. Since 1983, a gallon of gas has risen 30% relative to everything else.

So what things do you pay relatively more for now than your parents did, and what things cost relatively less?

"Stuff" is getting cheaper

The price of manufactured goods is way down. Televisions are now 98% cheaper than they were in 1983, according to the Consumer Price Index.

The index accounts for advances in technology. That 98% drop means a TV that costs $100 in 1983 -- with its dial controls and antenna -- would be worth about $2 today.

Toys are another example. The price of toys has fallen 78% compared to the overall level of inflation in the last 30 years. And clothing has fallen by 46%.

"We've experienced the 'miracle of manufacturing' over the last 50-60 years," said Mark Perry, an economist at the University of Michigan Flint School of Business. "Anything that is manufactured has become cheaper and cheaper over time."

Quiz: Cheaper or more expensive?

It's easy to attribute the decline in price for manufactured goods to outsourcing and rise of China's economy, but that's only part of the story.

Other advances in manufacturing include better supply chain management and, especially, automation. The manufacturing sector is currently going through what agriculture went through at the beginning of the last century. At the time, tractors and harvesters replaced human labor on the farms, vastly increasing the amount of food that could be produced and sharply lowering food prices.

The average family now spends less than 20% of their income on food and manufactured goods, according to Perry. That's down from over 40% in the late 1940s.

Perry expects these advances to continue, citing the advent of 3D printing and other technologies, and said the quality of manufactured goods should continue rising while the prices fall even further.

Services are getting pricier

What hasn't experienced a full on revolution is the services economy. As such, prices for services and specialty goods have soared.

The cost of college tuition has surged 227% over the rate of inflation since 1983, according to BLS. A hospital stay is up 197%, while prescription drugs are 89% more expensive. And housing costs are more expensive too -- up 14% from 1983.

What's happened is the demand for these things has grown substantially as people got richer, said Douglas Irwin, an economics professor at Dartmouth College. But advances in productivity -- the ability to churn out ever greater numbers for a cheaper price -- hasn't kept up.

It's possible that as the labor force moves from the factory floor to what Google Chairman Eric Schmidt calls the "creative and caring economy," there could be big gains in productivity, but economists have a hard time seeing it.

"It's hard to shift the supply curve," said Irwin. It's just not that easy to automate a college lecture, or a yoga class, or a visit to the doctor. ![]()

First Published: October 29, 2013: 6:55 AM ET

Bad credit can almost double your car insurance premiums

NEW YORK (CNNMoney)

Based on data from six large insurers from across the United States, InsuranceQuotes.com found that drivers with poor credit pay as much as 91% more than people with top credit scores.

And drivers with median credit scores were found to pay 24% more, the report found.

Insurers assess drivers using a special scoring model that is different than the one mortgage lender use. Instead of looking at your ability to repay a debt, this score aims to predict your likelihood of incurring future insurance losses, explained Laura Adams, an analyst at InsuranceQuotes.com.

Like regular credit scores, the insurance score is based on reports from credit bureaus and still takes into account things like late payments, outstanding debt, bankruptcies and new applications for credit.

Related: Great credit score? Think again

"About 40% of every consumer's bottom line score will be driven primarily by whether or not you paid your credit obligations on time," said Larmont Boyd of Fair Issac Corporation says on credit-based insurance rates.

"Responsible habits, such as paying your bills on time and minimizing debt, pay off in many ways, including paying less for car insurance," said Adams.

Basing car insurance rates off of credit scores is a controversial practice. Opponents say credit-based insurance rates are unfair because they largely and negatively affect low-income drivers. However, supporters say the scores benefit those with good credit.

California, Massachusetts and Hawaii have banned insurers from using credits scores to determine rates.

Related: How income inequality hurts America

A 2005 report from the Government Accountability Office found that a majority of Americans did not know their credit score could impact their insurance rates.

InsuranceQuotes.com adds that 97% of insurance companies have been referring to credit-based insurance scores for more than a decade.

Credit scores are one of many factors that insurers use to determine a driver's premiums. Other variables include age, gender, driving records and past insurance claims. ![]()

First Published: October 29, 2013: 7:00 AM ET

Superstorm Sandy victims still struggling to rebuild

Josette Lata and Ed O'Kinsky

NEW YORK (CNNMoney)

One major issue Sandy victims have: Their dealings with FEMA, the Federal Emergency Management Agency.

One year after the storm, Josette Lata and her husband Ed O'Kinsky have spent about $70,000 working on their property in Pine Beach, N.J.

Water damage accounted for most of the couple's costs, but their insurance covered only wind damage and provided just $3,500.

Related video: Sandy survivors mark 'year from hell'

The couple also received a $31,000 grant from FEMA. Much of that, however, went toward rent on a house where they lived while working on their property.

And the FEMA money came with strings attached, requiring them to buy flood insurance through the National Flood Insurance Program (NFIP). That insurance, though justifiable, could eventually cost $30,000 a year, according to Lata, a producer of photo and video shoots.

Not only that, but Lata and O'Kinsky feel that FEMA's guidance after the storm was costly.

First, the agency told them to make repairs quickly. The goal, says FEMA now, was to get people out of pricey temporary housing as soon as possible.

But then FEMA released new flood zone maps that put their home into the highest risk zone, requiring them to raise the house. Now, some of the early repairs have to be redone.

They've kept repair costs as low as possible with O'Kinsky doing much of the work himself. They also got help from volunteers with Waves for Water. O'Kinsky, a firefighter, has also helped other Sandy victims rebuild.

Related: Ravaged by Sandy but back in business

Timothy and Michelle Kelly had similar issues with FEMA, and still have not returned to their Long Beach, Long Island house.

The couple -- she's a teacher and he runs a pottery store -- got $74,000 from their flood insurance claim.

They then followed the FEMA playbook, and got going right away on repairs. They dealt with the electrical and hired a company to clean and sanitize the house.

But in January, their insurer notified them that the new flood zone risk calculations meant that they also had to raise the house. They found it was cheaper to knock it down and rebuild. The money spent on initial repairs was wasted.

"I'm glad all we did was clean the house and put in the new electricity," said Michelle.

The cost to rebuild will be around $300,000, and the couple is looking for help.

They were selected to receive donations rung up by ultra-endurance athlete Jason Lester, who ran 3,500 miles across America and raised about $20,000 for them.

Related: Top 10 cities to buy rental properties

George Morafetis owns a bungalow in Staten Island, N.Y., that took on six feet of water during the storm, causing interior damage. And the weight of the surge shifted the house on its foundation.

"It's not a total loss," said Morafetis, an actor who has appeared in movies and on a couple of episodes of "Law & Order." "My framing is tight and held up pretty well."

But he also is being hit with expensive changes because of new flood insurance rules.

For example, his street is being widened to help lessen the impact of future storms, and that means he will have to chop four feet off the front of his bungalow.

But to qualify for a FEMA grant of $20,000, he will also have to raise his house. That effort brings with it costs, such as a soil sample analysis to determine whether it can support a new foundation and getting an elevation certificate to determine his insurance rate.

"I'll spend [$20,000] before I can even request the grant," he said. ![]()

First Published: October 29, 2013: 8:07 AM ET

'I was overpaid by Social Security'

Written By limadu on Senin, 28 Oktober 2013 | 05.32

Rebecca Rivetto had received disability payments for four years for her autistic son. Now the Social Security Administration is asking for it all back.

NEW YORK (CNNMoney)

One 33-year-old veteran began receiving Social Security disability payments after his left foot was amputated following an explosion in Iraq in 2007. After going through rehab for his prosthetic leg, he began working full-time for a defense contractor in 2009. As soon as he started collecting a paycheck, the veteran, who asked to remain anonymous, reported his roughly $100,000 annual salary to the Social Security Administration.

When recipients of disability benefits reenter the workforce, they have a nine-month trial period in which they continue to receive benefits. Once the trial period ends and their earnings exceed a certain level -- currently $1,040 a month -- the payments are supposed to stop. And that's exactly what happened in his case.

But then, last July, he noticed a $75,000 deposit in his checking account. Three days later, a letter arrived from the Social Security Administration saying it had reinstated his benefits because he had not been "gainfully employed" during the past three years.

Related: Social Security makes $1.3 billion in overpayments

He called the agency and was told the mistake would be investigated. Finally, in November, he was notified that the benefits he received were indeed a mistake and he must repay the agency. But, oddly, the amount requested was a few thousand dollars less than the $75,000 overpayment he had received.

Worried he'd be accused of defrauding a federal agency, he filed an appeal -- which he was later told had been lost. His second appeal is still pending. While he hasn't had to pay any interest on the overpayments, he has had to pay more than $23,000 in income tax on that additional "income."

It turns out Social Security overpayments like these are surprisingly common.

A recent audit conducted by the Government Accountability Office found that Social Security made $1.3 billion in potential overpayments to disability recipients in just two years. While some of that amount can be attributed to fraudsters who game the system, many innocent people are also receiving overpayments and then being asked to pay the agency back. Some continue being paid even after they notify the administration that they are no longer eligible for benefits, while others have no idea they are being overpaid.

"People assume that if the government sends them a check, they're entitled to it," said Cheryl Bates-Harris, who runs the Social Security program at the National Disability Rights Network, which helps disability beneficiaries return to work.

Related: Federal disability trust fund on the brink

Daniela de la Piedra, an attorney at the Legal Counsel for the Elderly, said she deals with around 30 cases of disability overpayments per year -- one of her current clients has been asked to repay as much as $133,000 in benefits that was received over nine years. Michael Elsken, an attorney at Disability Rights Nebraska, has had clients who were asked to pay back as much as $60,000.

"It's enough to give someone a stroke or panic attack," Elsken said.

The Social Security Administration is unable to comment on specific cases due to privacy laws, but said its accuracy rate for disability payments exceeds 99%. It said the GAO's audit may have been flawed, and it plans to investigate the potential overpayments identified during the audit.

That's little solace for Amanda McFarling. When McFarling was under the age of 18, her mother was receiving disability payments on McFarling's behalf since she was considered a dependent. Now 20, McFarling is being asked to repay $3,847 in benefits that had been overpaid.

She only found out about the overpayments when her tax refund didn't show up this year and the IRS told her it had been taken by the Social Security Administration to repay a debt she owed.

"On top of being a recent graduate, still unemployed, with student loans to cover, [this debt] will follow me, and possibly my credit, for a significant amount of time," she said.

Related: Paying for special needs

She has applied for a waiver of the debt, and her case is still pending.

Rebecca Rivetto, 33, had been receiving $700 to $800 per month in Supplemental Security Income benefits, which are disability payments administered for low-income individuals. The money was for her two autistic sons -- one of whom is a 7-year-old who needs constant care because he can't communicate and isn't potty-trained.

When Rivetto's husband received a raise that meant their family no longer qualified for benefits, she reported the change in income to Social Security six months later. That turned out to be a big mistake.

After a lot of back and forth between various offices, she was ultimately asked to pay back all the benefits she had received over the last four years -- not just the extra six months. The agency said it had made a mistake and she never should have qualified for disability in the first place.

The result: a bill for $20,000, which is more than double the $8,000 she believes she was actually overpaid. She doesn't have enough money to hire a lawyer so she has given up, agreeing to pay $50 a month. It will take her more than 30 years to fully repay the debt.

"If I can pay them as little as possible until I die, that's what I'm going to do," she said. "It's just sad to me that this entity is there to help people who need help but then something like this happens where they're basically doing the opposite." ![]()

First Published: October 28, 2013: 6:23 AM ET

Stocks: Set for another all-time high?

Click on chart to track premarkets

NEW YORK (CNNMoney)

U.S. stock futures advanced, with the S&P 500 index up 0.2%.

The gains come after the S&P 500 hit a record high on Friday. The S&P, Dow and Nasdaq all rose by roughly 1% last week.

Investors have been broadly pleased by the latest batch of corporate earnings results.

Shares of Merck (MRK, Fortune 500) edged up before the opening bell after the drug maker reported better-than-expected sales and profit, even though they slumped compared to the year-ago quarter.

Burger King (BKW) reported an increase in sales and earnings, compared to a year ago. Apple (AAPL, Fortune 500) and Herbalife (HLF) are due to report in the afternoon.

Related: This could be Fed's largest stimulus yet

Stocks have also found recent support on hopes of continued stimulus from the Federal Reserve. The Fed has a policy meeting this week and is widely expected to say it will continue buying $85 billion in bonds and mortgage-backed securities a month. This unprecedented liquidity has buoyed equity markets around the world.

On the economic front Monday, the Census Bureau will release its monthly report on industrial production at 9:15 a.m. ET, and the National Association of Realtors publishes its monthly report on pending home sales.

Related: Investors wait for Fed, Apple and Facebook

European markets were lower in morning trading.

Nearly all Asian markets ended with gains Monday. Japan's Nikkei surged more than 2%, recovering from a near 3% drop on Friday.

Marc Chandler, strategist for Brown Brothers Harriman, said the rally was supported by strong earnings outlooks from exporters like Panasonic (PCRFF), Toyota (TM) and Canon (CAJ). ![]()

First Published: October 28, 2013: 6:20 AM ET

Obamacare and deficits: Reality check

The fight du jour over Obamacare is the troubled rollout of healthcare.gov. But the more enduring fight will be about the law's potential effect on federal coffers.

NEW YORK (CNNMoney)

Democrats promise trillions in savings. Republicans swear the law will bankrupt the country.

Alright, whatever. Here's what nonpartisan experts have said.

Will it reduce deficits or not? When the Affordable Care Act passed in March 2010, the nonpartisan Congressional Budget Office estimated that it would reduce deficits by more than $100 billion in the first decade, and by considerably more in the second decade -- by half a percent of economic growth. A half percent of GDP over a decade could mean reducing deficits by more than $1 trillion.

So, what's the problem? The CBO's estimate assumes that the law would be adhered to exactly as written.

Except that almost never happens with big legislation.

The CBO itself noted that the ACA would "put into effect a number of policies that might be difficult to sustain over a long period of time."

A number of changes have already been made, and more are being proposed -- some of which could diminish the law's deficit-reduction potential.

For instance, there's a push to repeal Obamacare's tax on medical devices. The tax is expected to raise about $30 billion over the next decade.

And there is concern that Congress could have a hard time adhering to various cost containment provisions in the law, said Joshua Gordon, policy director of the Concord Coalition, a deficit watchdog group.

If lawmakers keep messing with the law, then what? It depends on what they do -- but they could end up adding to deficits.

What if, for instance, they phase out key provisions intended to restrain spending growth in Medicare and don't implement a policy to slow the growth of health insurance subsidies?

Related: Is Obamacare slowing healthcare spending?

The Government Accountability Office did a long-range simulation that included these and other assumptions about the broader budget.

In such a scenario, the GAO found that deficits would go up 0.7% of GDP over the next 75 years. That would be due in large part to increased spending on Medicaid, the Children's Health Insurance Program and subsidies offered on the health insurance exchanges.

When will we know who's right? It may be awhile. Obamacare is a very complex law with lots of moving parts that phase in (and out) over time.

Already, growth in national health spending -- of which federal spending is a big part -- has fallen to a record low rate. The CBO and economists think part of that slowing is attributable directly or indirectly to the ACA, but it's unclear how much. And the growth rate is expected to rise in the next few years as more people become insured under Obamacare.

It also remains to be seen whether the new health insurance exchanges will draw a diverse pool of enrollees and generate enough competition to fulfill the law's promise of providing affordable health care for most Americans.

What makes Gordon optimistic that Obamacare can help improve the country's fiscal outlook long-term are the changes that hospitals, doctors and insurance companies are already making in attempts to slow cost growth.

"Underneath this surface fight over Obamacare, there's a huge amount of change and consensus on different ways to slow down health care costs and shift to a value-based health care system," Gordon said.

So what stokes his pessimism? The prospect that Congress could muck things up. ![]()

First Published: October 28, 2013: 7:42 AM ET

United fined $1.1 million over Chicago delays

Written By limadu on Minggu, 27 Oktober 2013 | 05.32

Passengers were stuck on planes for stretches ranging from just over three hours to nearly four-and-a-half hours.

NEW YORK (CNNMoney)

The DOT said the penalty is the largest for such a violation since a rule limiting long tarmac delays took effect in April 2010. The rule states that U.S. airlines with with 30 or more passenger seats on their domestic flights can't allow their planes to remain on the tarmac for more than three hours without giving passengers the opportunity to disembark.

Passengers on 13 United flights were stuck on their planes during severe thunderstorms on July 13, 2012 for stretches ranging from just over three hours to nearly four-and-a-half hours. Bathrooms were inaccessible on two planes for portions of the delays, the DOT said.

"It is unacceptable for passengers to be stranded in planes on the tarmac for hours on end," Transportation Secretary Anthony Foxx said in a statement.

Related: Toyota settles acceleration case after $3 million jury verdict

United said it was "committed to complying with the tarmac delay regulations, and we continue to improve our procedures while maintaining the safety of our customers and co-workers."

The fine amounts to a slap on the wrist for a company that reported $590 million in profits for the third quarter.

Correction: An earlier version of this story incorrectly stated that United was pursuing a merger with US Airways. The proposed merger is between American Airlines and US Airways. ![]()

First Published: October 25, 2013: 2:42 PM ET

JPMorgan paying $5.1 billion to Fannie, Freddie over mortgages

It's been a rough year for JPMorgan.

NEW YORK (CNNMoney)

The bank has also been in talks with the Justice Department and other government officials over another potential settlement based on similar claims. That settlement will likely be even more expensive for JPMorgan.

The claims relate to conduct at JPMorgan and at Bear Stearns and Washington Mutual, which JPMorgan purchased in 2008. At issue are allegations that the firms sold risky mortgages and mortgage securities while misrepresenting their quality.

Among the purchasers were Fannie Mae and Freddie Mac, the government-backed housing finance giants that required a massive bailout in 2008 when their housing investments soured.

The deal was announced by the Federal Housing Finance Agency, which has overseen Fannie and Freddie since their 2008 rescue.

Agency head Edward DeMarco said the accord "provides greater certainty in the marketplace and is in line with our responsibility for preserving and conserving Fannie Mae's and Freddie Mac's assets on behalf of taxpayers."

"This is a significant step as the government and JPMorgan Chase move to address outstanding mortgage-related issues," DeMarco said.

The firm reached the agreement without admitting or denying wrongdoing.

Related: More banks in crosshairs

JPMorgan will pay $4 billion to resolve claims related to the alleged misrepresentation of mortgage-backed securities -- investment products created by bundling payments from individual loans.

It will also repurchase $1.1 billion worth of mortgages sold to Fannie and Freddie between 2000 and 2008 that the firms say do not meet their quality standards.

JPMorgan (JPM, Fortune 500)said the settlements "are an important step towards a broader resolution of the firm's [mortgage-backed-securities]-related matters with governmental entities, and reflect significant efforts by the Department of Justice and other federal and state governmental agencies."

JPMorgan acquired Washington Mutual in 2008 after the failed bank had been taken over by the Federal Deposit Insurance Corporation. It's unclear whether JPMorgan will be able to pursue reimbursement claims with the FDIC for the portion of the settlement related to WaMu.

This issue has been a point of contention in JPMorgan's negotiations with the Justice Department, which wants to prevent the bank from passing on any settlement costs.

Securities sold by WaMu accounted for roughly $1.15 billion worth of the FHFA settlement.

Related: Half of nation's foreclosed homes still occupied

Investors initially shrugged off the news, which has been rumored for weeks. JPMorgan shares were up slightly in after-hours trading Friday, and have gained 20% so far this year.

JPMorgan is just one of 18 banks sued by the FHFA back in 2011 over the alleged misrepresentation of mortgage-backed securities, and is only the fourth to reach a settlement.

UBS (UBS) agreed to a settlement with the FHFA in July for $885 million. The agency has also settled with Citigroup (C, Fortune 500) and General Electric (GE, Fortune 500) for undisclosed sums.

JPMorgan is large enough to easily absorb the settlement costs. It's the biggest bank in the nation, with assets of $2.5 trillion and net income of $21.3 billion in 2012.

The bank has been buffeted by legal problems in the past few months, however.

It has paid over $1 billion in fines in connection with last year's "London Whale" trading debacle, and $80 million more over its allegedly unfair credit card billing practices.

In July, the bank agreed to pay $410 million to settle charges that it manipulated electricity prices in California and the Midwest. It is also facing scrutiny over its hiring practices in China and its alleged involvement in the Libor rate-fixing scandal.

JPMorgan posted a loss for the third quarter based on its massive legal expenses. CEO Jamie Dimon called the loss "painful" and warned that litigation costs could continue to be a drag on earnings for several quarters. ![]()

First Published: October 25, 2013: 5:26 PM ET

Feds seize $28 million in bitcoins from alleged Silk Road operator

There are currently about 11.9 million bitcoins in circulation, according to the website Blockchain.

NEW YORK (CNNMoney)

Bitcoin, which allows users to conduct online transactions while obscuring their identities, was the only currency accepted on Silk Road. Law enforcement officials arrested the site's alleged proprietor, Ross Ulbricht, earlier this month, and have shuttered the operation.

Ulbricht faces a potentially lengthy prison sentence for charges ranging from narcotics trafficking to computer hacking to money laundering. Federal officials have now seized over $33.6 million worth of bitcoins in connection with the case.

"This seizure sends a clear notice to those who think they can commit crimes and conceal the fruits of their criminal activities in digital anonymity," IRS Special-Agent-in-Charge Toni Weirauch said in a statement.

Ulbricht's lawyer could not be reached for comment.

Related: How porn links and Ben Bernanke slipped into Bitcoin's code

Silk Road operated on an anonymous network known as Tor, making activity on the site virtually untraceable.

The use of bitcoin gave buyers and sellers an extra layer of protection. The currency is anonymous, decentralized and can only be used in digital form.

To process bitcoin transactions, Silk Road used what the FBI described as a "tumbler," a complex system that used countless dummy transactions to digitally conceal a payment's origins.

Over the past two and a half years, federal officials say the site generated sales of more than 9.5 million bitcoins, a sum valued at about $1.8 billion at Friday's exchange rate. In addition to illegal drugs, the site offered weapons, hacking software and other illicit products.

Bitcoin surged in value earlier this year, when a banking crisis in Cyprus shook confidence in government-issued currencies. ![]()

First Published: October 25, 2013: 9:31 PM ET

JPMorgan paying $5.1 billion to Fannie, Freddie over mortgages

Written By limadu on Sabtu, 26 Oktober 2013 | 05.32

It's been a rough year for JPMorgan.

NEW YORK (CNNMoney)

The bank has also been in talks with the Justice Department and other government officials over another potential settlement based on similar claims. That settlement will likely be even more expensive for JPMorgan.

The claims relate to conduct at JPMorgan and at Bear Stearns and Washington Mutual, which JPMorgan purchased in 2008. At issue are allegations that the firms sold risky mortgages and mortgage securities while misrepresenting their quality.

Among the purchasers were Fannie Mae and Freddie Mac, the government-backed housing finance giants that required a massive bailout in 2008 when their housing investments soured.

The deal was announced by the Federal Housing Finance Agency, which has overseen Fannie and Freddie since their 2008 rescue.

Agency head Edward DeMarco said the accord "provides greater certainty in the marketplace and is in line with our responsibility for preserving and conserving Fannie Mae's and Freddie Mac's assets on behalf of taxpayers."

"This is a significant step as the government and JPMorgan Chase move to address outstanding mortgage-related issues," DeMarco said.

The firm reached the agreement without admitting or denying wrongdoing.

Related: More banks in crosshairs

JPMorgan will pay $4 billion to resolve claims related to the alleged misrepresentation of mortgage-backed securities -- investment products created by bundling payments from individual loans.

It will also repurchase $1.1 billion worth of mortgages sold to Fannie and Freddie between 2000 and 2008 that the firms say do not meet their quality standards.

JPMorgan (JPM, Fortune 500)said the settlements "are an important step towards a broader resolution of the firm's [mortgage-backed-securities]-related matters with governmental entities, and reflect significant efforts by the Department of Justice and other federal and state governmental agencies."

JPMorgan acquired Washington Mutual in 2008 after the failed bank had been taken over by the Federal Deposit Insurance Corporation. It's unclear whether JPMorgan will be able to pursue reimbursement claims with the FDIC for the portion of the settlement related to WaMu.

This issue has been a point of contention in JPMorgan's negotiations with the Justice Department, which wants to prevent the bank from passing on any settlement costs.

Securities sold by WaMu accounted for roughly $1.15 billion worth of the FHFA settlement.

Related: Half of nation's foreclosed homes still occupied

Investors initially shrugged off the news, which has been rumored for weeks. JPMorgan shares were up slightly in after-hours trading Friday, and have gained 20% so far this year.

JPMorgan is just one of 18 banks sued by the FHFA back in 2011 over the alleged misrepresentation of mortgage-backed securities, and is only the fourth to reach a settlement.

UBS (UBS) agreed to a settlement with the FHFA in July for $885 million. The agency has also settled with Citigroup (C, Fortune 500) and General Electric (GE, Fortune 500) for undisclosed sums.

JPMorgan is large enough to easily absorb the settlement costs. It's the biggest bank in the nation, with assets of $2.5 trillion and net income of $21.3 billion in 2012.

The bank has been buffeted by legal problems in the past few months, however.

It has paid over $1 billion in fines in connection with last year's "London Whale" trading debacle, and $80 million more over its allegedly unfair credit card billing practices.

In July, the bank agreed to pay $410 million to settle charges that it manipulated electricity prices in California and the Midwest. It is also facing scrutiny over its hiring practices in China and its alleged involvement in the Libor rate-fixing scandal.

JPMorgan posted a loss for the third quarter based on its massive legal expenses. CEO Jamie Dimon called the loss "painful" and warned that litigation costs could continue to be a drag on earnings for several quarters. ![]()

First Published: October 25, 2013: 5:26 PM ET

Feds seize $28 million in bitcoins from alleged Silk Road operator

There are currently about 11.9 million bitcoins in circulation, according to the website Blockchain.

NEW YORK (CNNMoney)

Bitcoin, which allows users to conduct online transactions while obscuring their identities, was the only currency accepted on Silk Road. Law enforcement officials arrested the site's alleged proprietor, Ross Ulbricht, earlier this month, and have shuttered the operation.

Ulbricht faces a potentially lengthy prison sentence for charges ranging from narcotics trafficking to computer hacking to money laundering. Federal officials have now seized over $33.6 million worth of bitcoins in connection with the case.

"This seizure sends a clear notice to those who think they can commit crimes and conceal the fruits of their criminal activities in digital anonymity," IRS Special-Agent-in-Charge Toni Weirauch said in a statement.

Ulbricht's lawyer could not be reached for comment.

Related: How porn links and Ben Bernanke slipped into Bitcoin's code

Silk Road operated on an anonymous network known as Tor, making activity on the site virtually untraceable.

The use of bitcoin gave buyers and sellers an extra layer of protection. The currency is anonymous, decentralized and can only be used in digital form.

To process bitcoin transactions, Silk Road used what the FBI described as a "tumbler," a complex system that used countless dummy transactions to digitally conceal a payment's origins.

Over the past two and a half years, federal officials say the site generated sales of more than 9.5 million bitcoins, a sum valued at about $1.8 billion at Friday's exchange rate. In addition to illegal drugs, the site offered weapons, hacking software and other illicit products.

Bitcoin surged in value earlier this year, when a banking crisis in Cyprus shook confidence in government-issued currencies. ![]()

First Published: October 25, 2013: 9:31 PM ET

MacBook Air is the best Apple laptop

Written By limadu on Jumat, 25 Oktober 2013 | 05.32

NEW YORK (CNNMoney)

It says a lot that the 2010 revamp of Apple's ultra-thin laptop was the lynchpin that single-handedly forced Intel (INTC, Fortune 500) to create the specifications for rival PC ultrabooks in 2011. Three years later, it's still the gold standard for laptop hardware -- and CNNMoney's Best in Tech for the Apple laptop category.

The MacBook Air's aluminum chassis is near perfect -- so much so that Apple (AAPL, Fortune 500) has gone nearly four years without making a major change to it.

On paper, the MacBook Air's low-power, dual-core Intel Core processor may seem modest, but it has been well-optimized to handle nearly anything you could throw at it. Web browsing, HD video and light photo and video editing are tasks well within the scope of the MacBook Air.

It also easily provides users with an entire workday's worth of power before having to recharge. Coders, gamers, and creative professionals will likely need more from their machines, but for the rest of us, the MacBook Air is plenty of machine. Apple's higher end MacBook Pro laptops are objectively more powerful. But for most people, the added benefits of the MacBook Pro simply don't justify the considerable extra cost over the MacBook Air, which starts at $999.

Related story: The iPad mini is now the iPad

Apple's multitouch trackpads are the best you'll find on any laptop, and the MacBook Air is no different. Spacious and responsive, you never have to think about getting the cursor where it needs to be on the screen, or having to click a specific part of the trackpad. The keyboard is also quite excellent, though a few companies, such as Lenovo, may be slightly better in that category.

The one current knock against the MacBook Air might be the display. It has always been good, but as PC competitors move to 1080p HD displays, the MacBook Air screen is starting to show signs of age. Still though, it is above average any way you look at it.

As for audio, laptop speakers are laptop speakers. They'll never replace a proper desktop system, or a good pair of headphones, or even a decent Bluetooth speaker. But for all basic personal uses, the MacBook Air speakers are fine.

Related story: Macs down, PCs up

There's a case to be made for the $999 11-inch MacBook Air (namely portability and value), but shelling out $100 more for the 13-inch model will give you a reasonablly sized screen and an SD card reader -- a wonderful convenience if you regularly use a stand-alone camera.

And when you compare the $1,099 MacBook Air to its competitors, you actually aren't subject to much of the alleged "Apple tax." Of course, there are cheaper 13-inch ultrabooks to be found, but they're lesser devices in many ways. When stacked up against other ultrabooks that promise the same combination of functional design and performance - as Acer, Asus, and Lenovo do - the MacBook Air is either on par or cheaper.

Apple laptops aren't for everyone. But for those who do prefer them -- or don't care one way or the other -- the 13-inch MacBook air is the best Apple laptop available. ![]()

First Published: October 25, 2013: 7:06 AM ET

Could teaching employees to code be key to success?

Modernizing Medicine has 16 physicians, in 8 different specialties, who have been trained to write code.

NEW YORK (CNNMoney)

Launched in 2010, his Boca Raton, Fla.-based firm designs electronic record-keeping systems for hospitals and doctors' offices. Like most tech startups, ModMed has a staff of engineers and software developers. What's more unusual is that it also has 16 physicians, in 8 different specialties, who write code.

"It's a lot easier to teach doctors how to program than it is to teach medicine to engineers," he said. Cane started ModMed with dermatologist Dr. Michael Sherling, who signed on after he grew frustrated with having to fill out routine paperwork multiple times.

"In the beginning, I tried getting Michael to explain to me how doctors think," Cane said. "We realized after about a week that that wasn't going to work."

Instead, he taught Sherling how to program and, together, they invented a new programming language specifically for medical records.

Related: 9 apps every business traveler needs now

Since then, the doctors they have brought on board have refined the company's cloud-based electronic medical records system, designed product updates and helped develop an iPad app. About 2,500 hospitals and medical practices now subscribe to ModMed's services, Cane said. And the company's revenues have soared from $2 million in 2011 to $9.3 million last year.

Cane believes ModMed's business model would work for any software firm that caters to a specialized professional market. "Banking, law, accounting, architecture -- there are plenty of fields where training subject-matter experts to be programmers would make a lot of sense," he said. "You could offer products and services to customers that most engineers and developers simply don't have the knowledge to design."

Teaching professionals from another field to be programmers can take some time, however.

"[It] depends on how computer-savvy they already are," Cane said. "But there are very basic, straightforward types of programming that any smart person can learn very quickly. Then, as they get proficient at those and gain confidence, they can move up to more advanced projects."

His main piece of advice for startups that want to follow ModMed's lead: "Instead of expecting subject-matter experts to think like engineers and conform to existing software, build the tools around the experts. Let their specialized knowledge dictate how you design the software."

Related: What I look for in a new hire

It's also essential, he added, to be highly selective about hiring. Sherling recruited most of ModMed's doctors from his vast network of colleagues and acquaintances. Even so, the company interviewed "many dozens" of physicians before handpicking its current crop.

"You want people who are not only distinguished in their field," Cane said, "but who are also excited about the chance to learn a new technical skill that can help others in their profession work smarter."

It was also important to Cane and Sherling that their recruits continued to practice medicine.

"It's important that they stay current, and try out our services in the real world, then create changes and improvements," said Cane. ![]()

First Published: October 25, 2013: 7:08 AM ET

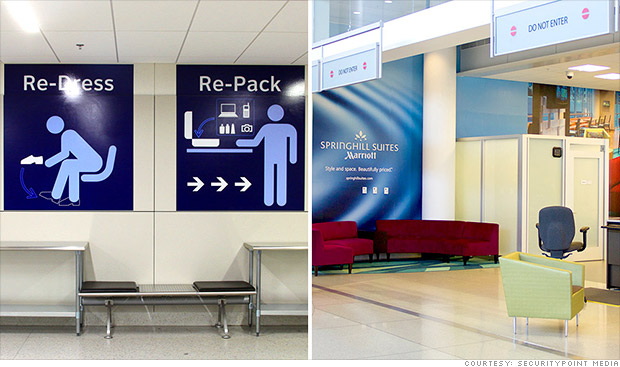

Four-star makeover for the TSA line

The Dallas-Fort Worth checkpoint used to offer stainless steel benches and tables (left). Now, like in Charlotte, travelers will find couches (right).

NEW YORK (CNNMoney)

But one company is trying to change that, bringing couches, mood lighting and music into the world of rope lines, stainless steel and body scanners.

A trial of redesigned security checkpoints at the Dallas-Fort Worth and Charlotte airports opened this month.

"Airports spend a lot of time and money on [comfort from] curbside to planeside, but there has been a gap at airport security," said Joseph Ambrefe, president of SecurityPoint Media, the company behind the new amenities. "Why shouldn't a checkpoint be appointed with the style of a four-star hotel lobby?"

The resemblance to a hotel lobby is no mistake -- the areas were funded by Marriott (MAR, Fortune 500) brand SpringHill Suites, in exchange for exclusive advertising in the areas. Ambrefe declined to say how much the areas cost.

Related: TSA's gun policy: Confiscate it, Instagram it

Travelers approaching the security line see monitors estimating their wait time. Upbeat music and professional announcements play from overhead targeted speakers -- to eliminate the need for TSA officers to shout instructions over the din.

You still have to take off your shoes and belt, but a "recomposure area" after the checkpoint gives travelers a less stressful environment to put themselves back together.

Ken Buchanan, an official at the Dallas-Fort Worth airport, said the checkpoint was part of the airport's effort to make "passenger screening a positive encounter, while maintaining the highest levels of security." The airport said it would evaluate the program's success in three months.

TSA officials didn't immediately respond to a request for comment.

Related: Airline pit crews race the clock

Most of SecurityPoint Media's business has revolved around the plastic bins that carry personal belongings through the x-ray machines. In exchange for maintaining the bin supply and storage carts free of charge, the company is allowed to plaster the bins with advertisements.

The bins and cart system improved efficiency and reduced security line wait times by 16%, according to a test of that program several years ago. It's now used at over 40 major U.S. airports.

If the couches and chairs bring similar improvements, Ambrefe said his company would look at expanding the comforts to additional airports. ![]()

First Published: October 25, 2013: 7:12 AM ET

VW said to help union organize its plant

Written By limadu on Kamis, 24 Oktober 2013 | 05.32

A worker at VW's sole U.S. plant in Chattanooga, Tenn.

NEW YORK (CNNMoney)

And some say Volkswagen management is encouraging, rather than discouraging, the UAW.

The UAW says it has union cards signed by a majority of the plant's hourly workers, a key step toward union representation. Workers at the VW plant make roughly $19 an hour compared with about $26 to $28 an hour for veteran hourly workers at the Detroit automakers, although the union's new hires are making closer to $17.

Why would Volkswagen management support unions?

VW says it wants German-style "works council" at the plant to get employees input. The councils meet on issues such as work rule disputes in order to improve plant efficiency.

VW, which has the best profit margins of any global automaker, has the works councils at more than 100 plants around the globe -- all except those in China and its sole U.S. factory.

But U.S. labor law makes it difficult to set up such councils without participation by a union.

Related: VW heading for a profit speed bump?

Anti-union critics say VW is illegally pressuring employees to accept a union many don't want. They also worry that a unionized plant would hurt bids to attract other automakers to Tennessee.

The National Right to Work Foundation, a leading anti-union group, has filed a complaint with the National Labor Relations Board about VW's efforts.

"They're worried about them getting a foot in the door," said Gary Chaison, professor of labor relations at Clark University. "Every time you get a large organizing campaign that is successful, it inspires more organizing."

VW unveils 'world's most efficient car

VW is somewhat less inclined to be anti-union than the typical U.S. company. Half its board is made up of employee representatives, mostly from Germany's powerful trade unions.

Still, the company denies it is backing the union effort, despite what critics fear.

"I think we've been very clear that that process needs to run its course, that no management decision has been made and that it may or may not conclude with formal, third-party representation," said Jon Browning, VW's U.S. CEO on a recent call with analysts.

UAW's membership has declined for decades and union leadership has made organizing the factories of Japanese and European automakers their top priority. So far, the efforts have all been unsuccessful. ![]()

First Published: October 24, 2013: 7:05 AM ET

Americans lacking in basic skills

NEW YORK (CNNMoney)

American adult proficiency in literacy, numeracy and problem solving ranks as some of the lowest among developed countries, despite a relatively high level of education, according to a recent survey.

In literacy, the United States came in 9th out of 13 industrialized countries surveyed, according to a report from the Organization for Economic Cooperation and Development.

In problem solving America ranked 8th, right below average. And Americans are particularly bad at math, coming in third from last in the numeracy rankings.

"It's distressing to see we are not performing well," said Mary Alice McCarthy, a senior policy analyst at the New America Foundation. "Young people are moving into adulthood and they do not have the necessary skills."

This comes despite the fact that the number of years Americans are expected to spend in school -- 17.1 -- is just below the OECD average of 17.5 years, and above the 16.6 years expected in the U.K. and the 16.2 years in Japan.

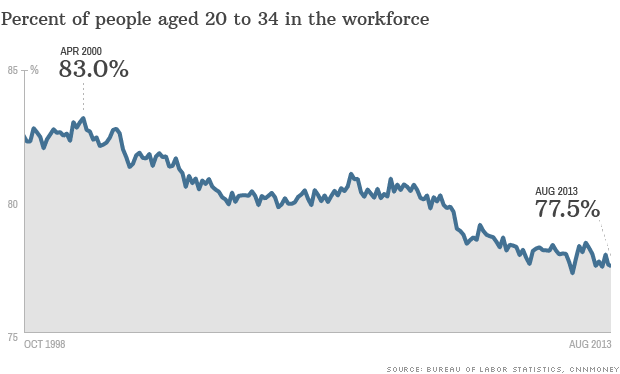

Related: Why young people are saying 'no' to the workforce

McCarthy said one thing that was particularly problematic is that young people in the United States are not showing a much higher level of skill than older people, despite the fact that the jobs of tomorrow will require a greater degree of knowledge.

The report attempted to measure the reading, math and problem solving skills in real world situations of over 5,000 Americans between the ages of 16 and 65.

It noted that a lack of these skills translated into real life hardships, and they were especially pronounced in America. In the United States, the odds of being in poor health are four times greater for low-skilled adults than for those with the highest proficiency -- double the average of other countries in the study.

One of the reasons America may not have scored so high is immigration, said William Thorn, a senior analyst in the education division at OECD. Immigrants tend to have fewer skills, and can bring down the average.

As with income inequality, the skills disparity was also high in the United States, said Thorn, with a big discrepancy between the good and poor performers.

Yet having a high skill set doesn't necessarily translate into a more productive economy or greater economic output. After all, Japan topped the list in both reading and math yet hardly has a red hot economy.

"The skills of a population are not entirely summarized by literacy, numbers and problem solving," said Thorn.

Related: 10 hard-to-fill jobs

Still, if we want to right the situation, grades K-12 seem to be the place to start -- American college students tended to have skills more on par with their international peers.

There are no shortage of ideas on how to make America's schools better. Sandra Stotsky, a retired education professor at the University of Arkansas' Department of Education Reform, thinks students need to be held more accountable. There needs to be less testing throughout the year, but more high-stakes testing at crucial times. If students don't pass the test, they don't move on to the next grade.

Stotsky also thinks students need more options to go into the trades in high school instead of a relentless focus on sending kids to college, especially when they are not prepared.

Finally, a greater cultural emphasis reading would do wonders, Stotsky said.

"Our students spend an enormous amount of time watching TV and playing video games," she said. "How can we expect high levels of literacy from people who don't read?"

Other ways to boost the U.S. skill set include greater access to early childhood education and more adult education programs targeting low-skilled workers, said New America's McCarthy. ![]()

First Published: October 24, 2013: 7:02 AM ET

Pensions ask retirees to pay back tens of thousands

Carole Grant, 75, has been told she owes almost $61,000 for nearly 20 years of pension overpayments.

NEW YORK (CNNMoney)

For retirees, it can mean owing tens of thousands of dollars. And with little warning, their pension checks are being slashed to cover their debt.

In April 2011, New Jersey resident Carol Montague received a letter from American Water Works Co.'s pension plan saying it had overpaid her for more than five years and wanted its money back -- plus interest. Montague, now 67, was told she owed roughly $45,000.

Two weeks later, Montague's pension benefits dropped from $1,246 to around $325 a month, or half what she should have been paid all along. The plan takes out roughly $300 a month in order to pay itself back.

Once Montague's health care premium is deducted, her monthly pension check shrinks to less than $25. She gets another $1,200 a month from Social Security, but it's not enough. So, in addition to her part-time job as a school crossing guard, she is working as a salesperson at Macy's.

So far, Montague has repaid almost $9,000 -- calculations show that she won't repay her debt in full until 2024.

Related: Just how generous are Detroit's pensions?

American Water said Montague signed a document verifying the correct pension amount and that they are legally allowed to collect any overpayment, with interest, to protect the viability of the pension fund. Montague acknowledges she made a mistake, but didn't think she needed to confirm that her benefits matched the amount in the letter she had signed almost a year before she retired.

"I put it away in a steel box. I never looked at it again. It was stupid on my part," she said. "But it took (almost) six years for them to find out they overpaid me?"

With the help of the Mid-Atlantic Pension Counseling Project, a government-sponsored program, she has appealed to the pension plan to waive the interest, as well as ease some of the overpayment burden. But the plan has refused.

As pensions face increased financial scrutiny -- and shrinking funds -- pension counseling programs are seeing even more cases like Montague's.

This year, nearly 600 retired metal workers and their spouses are facing these so-called recoupment demands from the Sheet Metal Workers Local Union No. 73 Pension Fund, based outside of Chicago.

Related: Will your congressman retire richer than you?

In a letter sent to the pension recipients in May, the fund said a 2010 audit found that certain pensions were calculated incorrectly from 1974 to 2004, resulting in more than $5 million in overpayments, according to an IRS filing. The fund is now demanding that the retirees pay back decades worth of mistakes, including interest based on the plan's rates of return.

In July, the pension fund reduced hundreds of checks to the proper payment amount and then again, to make up for the overpayments, often by as much as 25%.

Since the pension fund is forecasting that many of the retirees will die before their debts are repaid, it is asking many of them to make large upfront payments.

It's unclear why the pension fund, which did not respond to requests for comment, waited several years to make the adjustments.

Carole Grant, 75, was told by the sheet metal worker's plan that she owed almost $61,000 (roughly half of which was interest) for nearly 20 years of overpayments on the spousal benefits she received from her deceased husband's pension. Her monthly benefit of $394 should have actually been $249, the pension fund said.

Related: Are you saving enough for retirement?

As a result, she's been asked to make an upfront payment of $54,000 and her check has been reduced to $187 a month. While she has other sources of income, she doesn't think she should have to turn over her retirement savings.

"I don't feel that I should be penalized for the mistakes that they made," she said.

Karen Ferguson, director of the Pension Rights Center, a Washington D.C.-based advocacy group, said that, in most cases, retirees have no idea they are being overpaid since "the way a benefit is figured in a typical pension plan is impossible for an ordinary person to fathom."

She called the sheet metal workers case the "most egregious" she's seen, underscoring the need for federal regulations, such as imposing a statute of limitations and limiting how dramatically a pension check can be reduced. She also said many retirees don't realize that plans rarely take legal actions to recover the lump sums.

Money 101: Planning for retirement

While some of the retired sheet metal workers have been able to get their debts forgiven or reduced by filing "hardship waivers," many have had appeals denied, said Tim Kelly, an attorney representing some of the retirees.

One of his clients, 63-year-old Ed Cochran, has received a disability pension since 1995 and was told he owes the fund nearly $100,000, $42,464 of which is interest. His monthly checks had included an excess $262 a month.

Cochran paid years' worth of income taxes and child support based on the amounts he received. And he's heard of many retirees in worse financial shape than him.

"There are so many other older retirees who didn't plan for rainy days," Cochran said. "This is all they have."

Have you received a recoupment demand? Visit the Pension Rights Center website for advice or for pension counseling referrals. ![]()

First Published: October 24, 2013: 6:59 AM ET

How sick are Europe's banks? Wait and see

Written By limadu on Rabu, 23 Oktober 2013 | 05.32

Eurozone bankers will be flying into Frankfurt shortly to meet with the ECB as part of a year-long health check announced Wednesday.

LONDON (CNNMoney)

An ambitious health check announced Wednesday by the European Central Bank is the first serious attempt to tackle the problem, but it won't produce results for at least a year, and could perversely make things worse before they get better.

European leaders agreed in 2012 to give the ECB responsibility for supervising the eurozone's biggest lenders, the first step towards creating a banking union they hope will reduce the risk of future bank failures triggering sovereign debt crises.

Before it begins that task in late 2014, the ECB will review risks and asset quality at 128 banks across 18 countries, including major players such as Deutsche Bank (DB), Santander (SAN) and Unicredit (UNCFF), culminating in a series of stress tests next year.

Eurozone banks have raised 500 billion euros from investors and governments over the past five years, equivalent to about 5% of annual GDP. The ECB will have the power to order banks to raise more cash if deemed necessary by the review.

The eurozone emerged from a prolonged recession earlier this year. Yet growth remains anaemic, and lending and investment in some of its weakest economies hobbled by uncertainty over how much risk banks are carrying on their books.

Bailouts, austerity, economic reforms and ECB support have prevented the eurozone falling apart but economists believe a return to healthy growth will only happen once the cloud hanging over the banking sector is lifted.

Related: Europe's recovery is weak, warns ECB

ECB President Mario Draghi said transparency was the primary goal of the review, which will cover 85% of the eurozone's banking assets.

"We expect that this assessment will strengthen private sector confidence in the soundness of euro area banks and in the quality of their balance sheets," he said.

Analysts say the ECB will have to walk a fine line between making the health check tough enough to be credible to investors and depositors, and not so tough it prompts banks to rein in lending even further as the review drags on.

"Some major European banks may still have a reason to grant few new loans and hence incur new risks until sometime in 2015," said Christian Schulz, senior economist at Berenberg bank.

And eurozone governments still have much more work to do if they're to realize their goal of a banking union. There's still no agreement on how to recapitalize weak banks if they're unable to raise enough funds from the private sector, nor on common rules for winding up a failing bank. ![]()

First Published: October 23, 2013: 6:49 AM ET

To fix Obamacare website, blow it up, start over

NEW YORK (CNNMoney)

After assessing the website, Dave Kennedy, the CEO of information-security company Trusted Sec, estimates that about 20% of Healthcare.gov needs to be rewritten. With a whopping 500 million lines of code, according to a recent New York Times report, Kennedy believes fixing the site would probably take six months to a year.

But would-be Obamacare enrollees only have until Dec. 15 to sign up for coverage starting at the beginning of 2014. Nish Bhalla, CEO of information-security firm Security Compass, said it "does not sound realistic at all" that Healthcare.gov will be fully operational before that point.

"We don't even know where all of the problems lie, so how can we solve them?" Bhalla said. "It's like a drive-by shooting: You're going fast and you might hit it, you might miss it. But you can't fix what you can't identify."

Several computer engineers said it would likely be easier to rebuild Healthcare.gov than to fix the issues in the current system. But it's unlikely that the government would toss out a reported $640 million worth of work.

Related story: Healthcare.gov review: needs a lot of work

The sheer size of Healthcare.gov is indicative of a major rush job. Rolling the site out too quickly likely increased the number of errors, and that makes the fixes more difficult to implement.

"Projects that are done rapidly usually have a lot of [repetitive] code," said Arron Kallenberg, a software engineer and tech entrepreneur. "So when you have a problem, instead of debugging something in a single location, you're tracking it down all through the code base."

To put 500 million lines of code into perspective, it took just 500,000 lines of code to send the Curiosity rover to Mars. Microsoft's (MSFT, Fortune 500) Windows 8 operating system reportedly has about 80 million lines of code. And an online banking system might feature between 75 million and 100 million lines. A "more normal range" for a project like Healthcare.gov is about 25 million to 50 million lines of code, Kennedy said.

"The [500 million lines of code] says right off the bat that something is egregiously wrong," said Kennedy. "I jumped back when I read that figure. It's just so excessive."

Applicants might be able to at least register for Obamacare sooner than that, even if the site isn't 100% perfect. The New York Times report said five million lines of code need to be replaced just so the site can run properly.

Related story: Obamacare website a work in progress, government says

But the Obamcare website has bigger problems than simply getting people registered for health care. The code is also riddled with security holes, according to Kennedy, who outlined his cybersecurity concerns on Trusted Sec's company blog.

"If someone can't register, that's obviously bad -- but if the information gets hacked, you're talking about one of the biggest breaches in American history," Kennedy said. "I think security is an afterthought at this point."

That might not be a major issue now, as people are still having trouble logging onto the site. But once it's up and running, that code had better be made more secure.

"At this point, the car isn't even moving," Bhalla said. "But once we're speeding down the road, you're going to want that seatbelt to work." ![]()

First Published: October 23, 2013: 7:04 AM ET

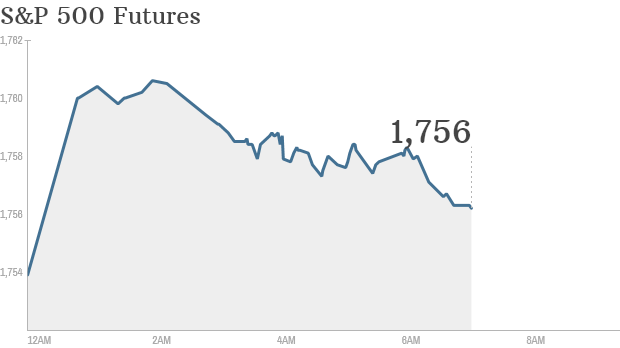

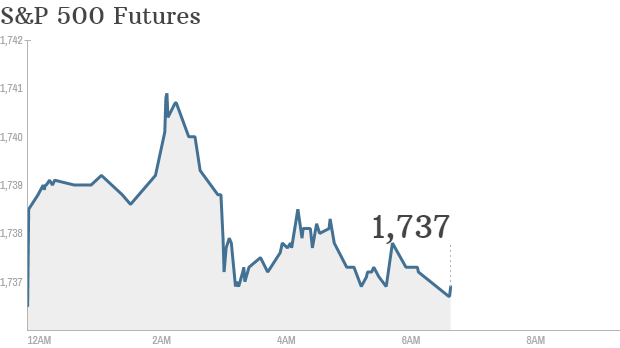

Stocks: Momentum fades with earnings eyed

Click on chart to track premarkets

NEW YORK (CNNMoney)

U.S. stock futures were lower, matching a weak performance across most global markets.

The pullback comes as major U.S. indexes hover near historically high levels.

The S&P 500 hit a fresh record Tuesday after a disappointing jobs report for September fueled expectations that the Federal Reserve will continue to prop up the U.S. economy and delay any tapering of its massive bond-buying program until 2014.

Related: More banks in the crosshairs after JPM deal

All eyes on earnings: Northrop Grumman (NOC, Fortune 500) reported earnings and sales above expectations and raised its out look for the year.

Boeing (BA, Fortune 500) reported a surge in quarterly profit and revenue as the aircraft manufacturer works its way through a backlog of orders. The stock rose in premarket trading.

But Caterpillar (CAT, Fortune 500) reported a slump in sales and earnings, noting that a slowdown in the mining sector has taken a bite out of heavy equipment manufacturing. The stock dropped.

AT&T (T, Fortune 500) is scheduled to report after the close.

So far, 80 of the 130 S&P 500 companies have beat expectations, according to S&P Capital IQ. But analysts still expect weakness in earnings for the year.

Related: Fear and Greed index is getting greedy

Shares of Corning (GLW, Fortune 500) rallied after the company announced a $2 billion stock buyback, as well as a partnership with Samsung Display, which manufactures LCD glass in Korea.

Netflix (NFLX) shares extended their decline, which started after hedge fund manager Carl Icahn revealed that he had reduced his stake in the company.

European markets were lower in afternoon trading, while Asian markets ended firmly in the red. Japan's Nikkei index slumped 2% as a stronger yen hurt exporters, and stocks in Hong Kong and China closed with heavy losses.

Asian markets were dragged down by reports that the leading banks in China had tripled the volume of bad loans they wrote off in the first half of the year, according to Marc Chandler, strategist for Brown Brothers Harriman. ![]()

First Published: October 23, 2013: 4:57 AM ET

Why young people are saying 'no' to the workforce

Written By limadu on Selasa, 22 Oktober 2013 | 05.32