Wall Street isn't digging the Democratic party right now.

NEW YORK (CNNMoney)

A record 63% of the political contributions from employees and corporations in the banking and investment sectors went to Republicans this election cycle, according to data from the Center for Responsive politics. It's the largest dollar figure ($78 million) and percent for the GOP in any midterm election.

The donations are likely based on a bet that Republicans have the best shot at victory on Tuesday.

Related: Wall Street predicts GOP mid-term victory

"You want to be with the winner," said Dorsey Farr, co-founder of French Wolf & Farr, an investment advisory firm in Atlanta. "A lot of times you'll see companies give to both parties. If they see the tide turning, they'll go with the flow."

The figures don't include money channeled through political action committees, which have played an increasingly prevalent role in campaign finance in recent years.

But the boosted election expenditures from the financial world this time around also have to do with the fact that the Democratic Party has turned up the heat on Wall Street since the financial crisis.

"Democrats are just more of the regulatory party," said Ray La Raja, a political science professor at the University of Massachusetts - Amherst, adding that they used to be more amenable to the things Wall Street cared about.

Related: Complete coverage of the 2014 midterms

"In the past bankers could work with any party. Now, all things equal, they'd rather work with Republicans," he claimed.

But beyond the strategic calculations, there's also a philosophical element, with many on Wall Street having grown tired of being punished for their industry's past deeds.

Almost all of the major banks have paid out unprecedented multi-billion settlements in recent years for their role leading up to the financial meltdown.

They've also become a political punching bag.

Early in his first term, President Obama famously contended that he didn't get elected to help out "a bunch of fat cat bankers on Wall Street." And he's repeatedly tried to close tax loopholes that benefit hedge fund and private equity managers.

"Wall Street feels rightly or wrongly like they've been demonized by this administration," asserted La Raja.

But it doesn't really matter to most people whether or not a bunch of investor types have had their feelings hurt.

Related: Millionaire tax on the ballot in Illinois

In fact, the populist backlash against Wall Street excess still plays a prevalent role in politics. In a recent interview with Salon, prominent Senator Elizabeth Warren (D-Massachusetts) lambasted the president's economic team for picking Wall Street over Main Street.

And possible 2016 Democratic presidential candidate Hillary Clinton had to backpedal from comments she made at an event earlier this month in which she told the crowd, "don't let anybody tell you that it's corporations and businesses that create jobs."

Warren spoke at that same event, and political commentators were quick to speculate that Clinton was appealing to her party's left leaning, anti-Wall Street base.

According to La Raja, the populist theme will continue to resonate with voters into the 2016 Presidential election as long as the economic recovery remains sluggish for many Americans.

Related: Will this get millennials to buy homes?

On the other hand, "If all engines are running and the economy is doing well, populism dies."

Still, it's not as if Wall Street has totally abandoned Democrats. Senator Cory Booker (D-New Jersey) was the top recipient of contributions from members of the investment community this election, having raked in almost $1.9 million.

Charles Schumer (D-New York), traditionally a friend of Wall Street who sits on the the influential Senate Finance Committee, pulled in about $850,000.

"I'm sure they're not going to piss off a powerful Democrat," La Raja said of big Wall Street donors.

First Published: November 3, 2014: 7:28 AM ET

Singapore is the best place to do business, the World Bank said.

Singapore is the best place to do business, the World Bank said.

Wall Street isn't digging the Democratic party right now.

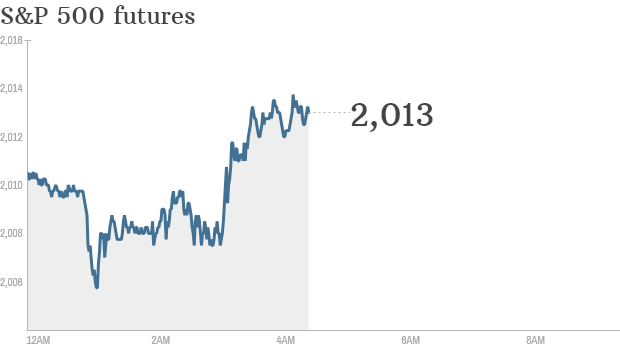

Wall Street isn't digging the Democratic party right now.  Click chart for in-depth premarket data.

Click chart for in-depth premarket data.  The Ellerbroek family.

The Ellerbroek family.

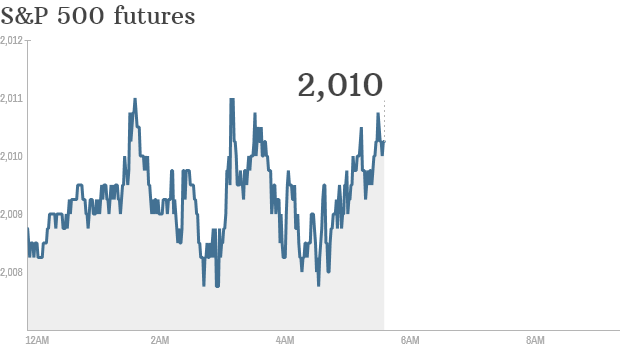

Click chart for in-depth premarket data.

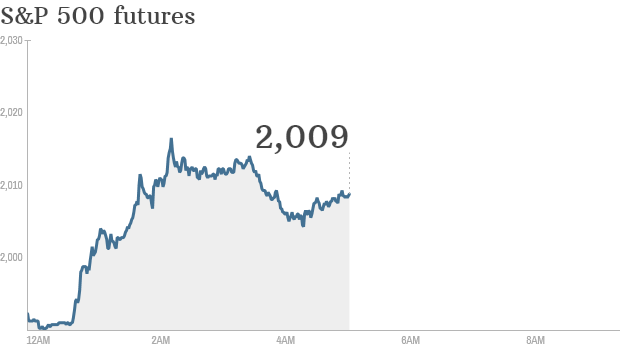

Click chart for in-depth premarket data.